Economic Charts

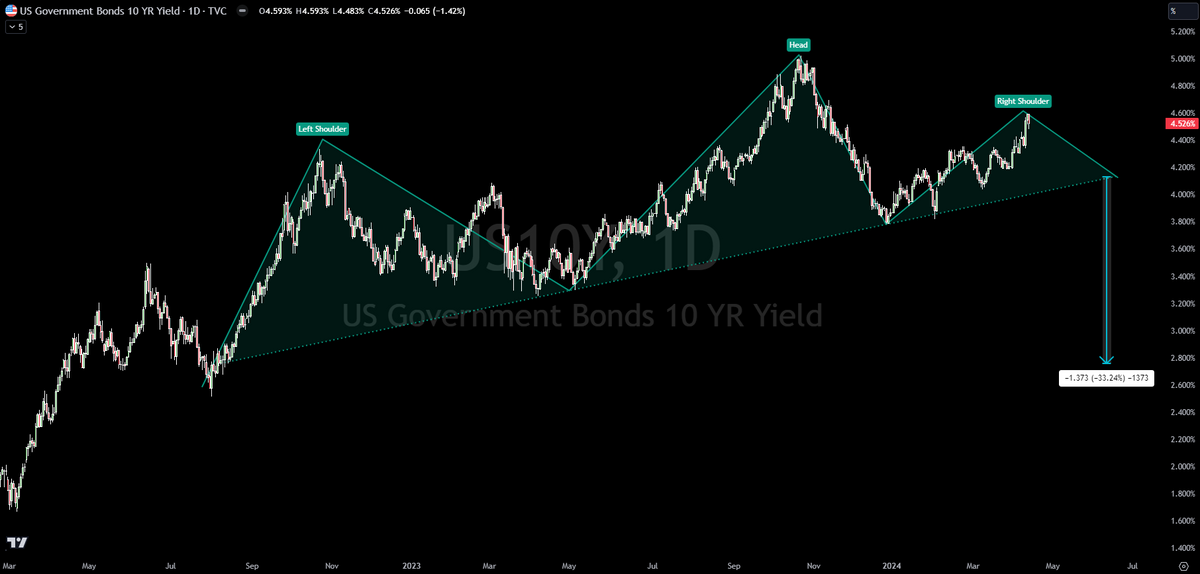

Technical Analysis: Head And Shoulder On The 10 Year Yield

Updated: Apr 22, 2024 | Published: Apr 13, 2024

There is an increasing probability that the 10 year yield is topping. Fear, like we are seeing in the stock market, causes risk off. One of the major risk off trades is a run to safety in bonds. When investors buy bonds, the yields start to fall.

If risk off continues, yields will continue to fall. This could be because of geopolitical turmoil or a slowing U.S economy. Either way, the probability of this happening is increasing dramatically.

Should the inverse head and shoulder continue to form and break the neck-line, the downside calculation on yield target would be 2.75%. That would be a dramatic fall on yields and investors have to wonder what the global and U.S. economy look like under that interest rate.