The Federal Reserve Is Making Recessions Much Worse

The Federal Reserve has two mandates, keep prices stable (inflation low) and to keep employment high. This dual mandate was given to them in 1977. From that point on, they began to tinker with the monetary system more and more. In started the downfall of our system.

Prior to 1977, the only job of the Federal Reserve was to keep the banking system stable.

It is no coincidence that from 1977 on, the middle class has declined and the United States has become more and more a two class system; rich and poor.

Forcing the Federal Reserve to worry about employment created a conflict of interest. Normal recessions where the banking system was still stable were no longer fine if unemployment spiked. The Federal Reserve has been forced to lower interest rates aggressively and print money to quickly exit a recession.

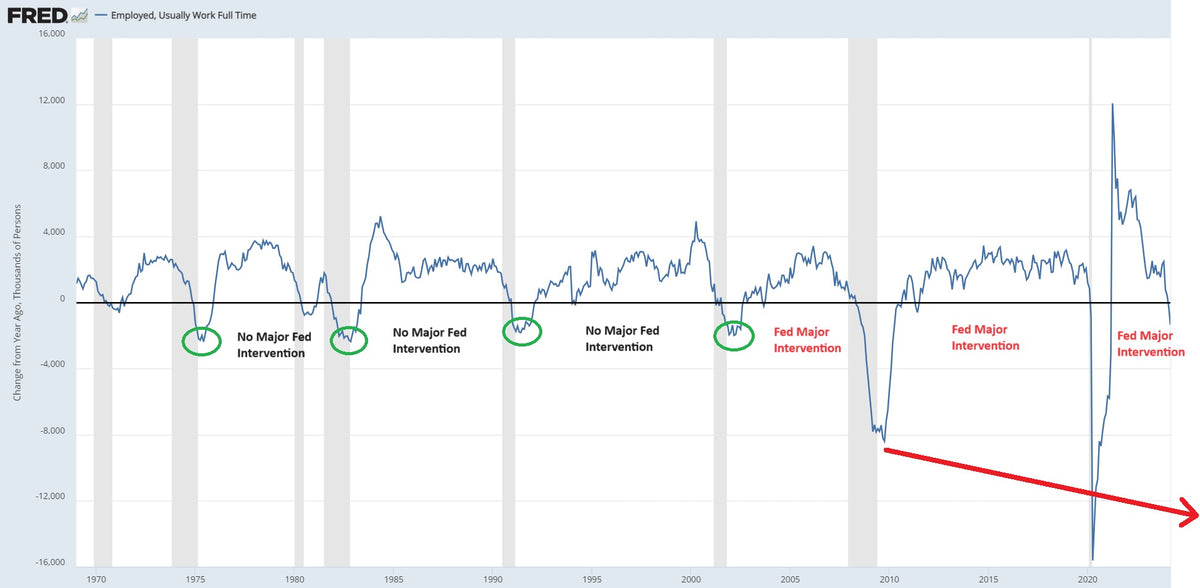

The chart above clearly shows that since the dual mandate, the amount of people losing full-time work gets worse and worse. This is because the Federal Reserve does not allow for normal recessions to take their course every 4-6 years. They print the economy back into expansion, injecting drugs (liquidity). However, when the collapse inevitably occurs, it is far worse. Almost like a drug addict overdosing and flatlining.

The concern for smart economists is the amount of stimulus poured into the system in the last decade. What kind of recession or depression does this set the United States up for in the coming years? The trend of full-time job losses is staggering.