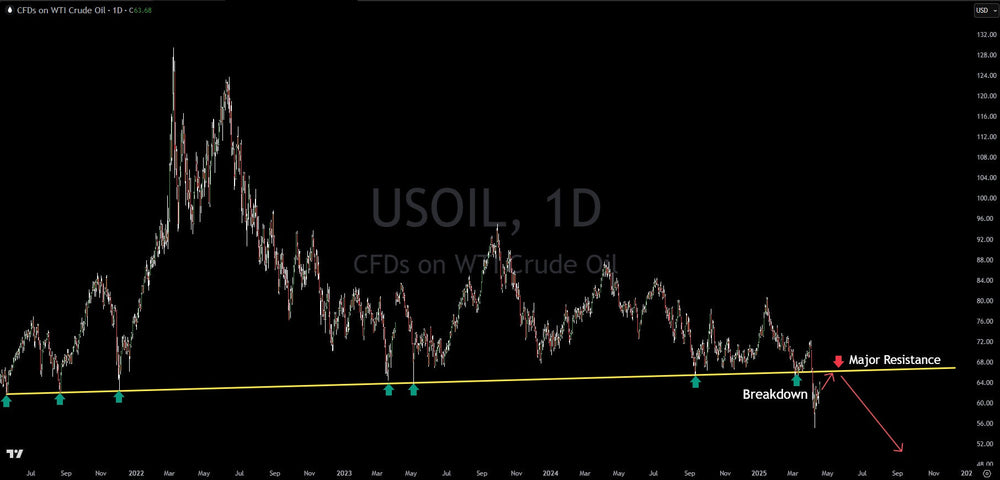

Technical Analysis: Oil Minor Upside Before Next Big Drop

Oil prices experienced a notable technical breakdown weeks ago, falling sharply below a critical long-term support trendline at $66/bbl. This trendline was a significant technical feature, having provided support since 2021 and been successfully defended on seven previous occasions before the recent decisive breach and confirmation. In the latest week, oil has shown minor upside, which appears to be a typical retracement following such a breakdown.

Technical analysis suggests this bounce is likely to extend towards the level of the former support trendline, now acting as formidable resistance, located near $66 per barrel. The principle of broken support becoming resistance is a fundamental tenet in technical charting. Therefore, a strong price rejection is anticipated upon reaching the $66 resistance zone. This expected rejection should trigger the next major leg lower for oil prices, with a projected target of $50 per barrel or below. The near-term outlook favors a push to $66 before a significant sell-off takes hold, driving prices towards the $50 level.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.