Trader's Resource Center

Welcome to the Trader's Resource Center, your hub for essential trading tools, educational resources, and expert insights designed to elevate your market knowledge. This center provides everything you need to refine your trading skills and understand market trends. Explore detailed guides, actionable strategies, and expert analysis to make informed decisions and achieve consistent success in your trading journey.

Latest Video

Stock Trading 101

Ready to dive into the exciting world of stock trading? Unlock the fundamentals and take your first step toward financial freedom. Download our free eBook and start your trading journey today!

Top Trading Mistakes Webinar

This webinar aims to provide insights for beginners on common trading pitfalls to avoid. Gareth Soloway, a master trader and creator of The Winning Trader Series, will guide you through essential considerations as you embark on your trading journey.

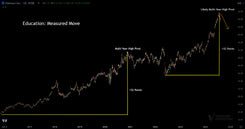

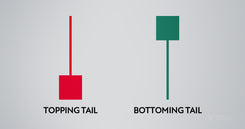

Apprentice Trading Library

The Apprentice Trading Library is a free course designed to give beginners a solid foundation in trading. Covering essential concepts and strategies, this course provides the basic knowledge needed to navigate the financial markets confidently. With new lessons released every week, you can continuously build your trading skills and stay updated on key fundamentals. See all lessons here.

Trader's Insights

Trader's Insight delivers expert analysis and market perspectives to empower traders with informed decision-making. It equips you with the insights and strategies needed to stay ahead in a constantly evolving market. See all articles here.

Trader's Tools

Trader's Tools is your essential resource for powerful trading solutions designed to enhance your decision-making and execution. Access tools that simplify complex market data and help you navigate trading opportunities with greater efficiency.

Recent Insider Buying And Selling

The market constantly shifts, but subtle clues offer insight. Analyzing 60-day market movement charts and insider trading, combined with fundamental analysis, can help predict trends and guide informed decisions.

Fed Watch

The CME FedWatch tool helps investors gauge market expectations for Federal Reserve rate cuts or hikes, with recent trends showing a growing belief in earlier cuts. By using this tool, investors can make informed decisions by understanding market sentiment around Fed actions. Whether anticipating interest rate shifts or other policy changes, traders can leverage probability charts to adjust their strategies, positioning themselves effectively for potential market movements in response to Fed decisions.

Earnings Calendar

The Weekly Earnings Calendar highlights key upcoming reports, helping traders stay informed, track important dates, and plan their strategies effectively.

Economic Calendar

The Economic Calendar tracks key financial events and data releases, helping traders stay informed and make timely decisions. Easily monitor market-moving events to refine your trading strategies.

Stock Heat Map

The Stock Heat Map visually highlights market performance, showing the strength and weakness of stocks within an index or sector. With color-coded tiles, traders can quickly spot trends and opportunities, making informed decisions with ease.

Crypto Heat Map

The Crypto Heat Map visually displays market performance, highlighting the strength and weakness of various cryptocurrencies. With color-coded tiles, traders can quickly spot trends, track price changes, and identify opportunities to make informed decisions efficiently.

Stock Market Fear & Greed Index

The Fear & Greed Index gauges stock market movements and pricing fairness. Excessive fear typically lowers share prices, while heightened greed has the opposite effect.

Crypto Market Fear & Greed Index

The Fear & Greed Index evaluates cryptocurrency market dynamics and pricing equity. Excessive fear often depresses prices, whereas heightened greed tends to inflate them.