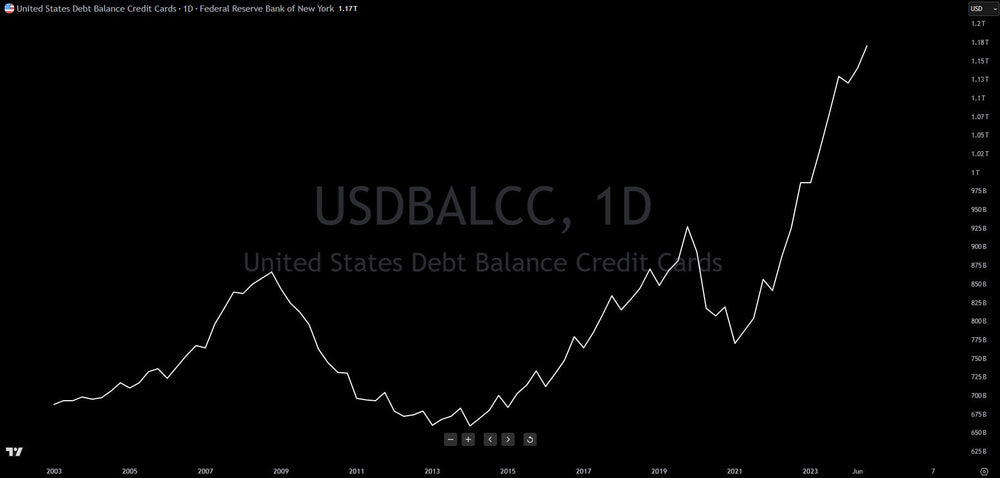

Credit Card Balances Balloon To $1.18 Trillion As Consumers Struggle

Consumer reliance on credit cards is increasing, raising concerns about the economy's health. The Federal Reserve Bank of New York recently reported that total credit card debt has reached a record $1.17 trillion. This surge suggests a growing number of consumers are struggling financially and only making minimum payments.

While higher-income consumers, potentially benefiting from stock market gains, appear to be maintaining their spending, middle- and lower-income households are facing increasing financial pressure. This pattern of lower-income consumers struggling first, followed by the middle- and then higher-income brackets, is a typical precursor to economic recessions. The rapid growth of credit card debt since the post-COVID lows is a significant warning sign that investors should carefully monitor.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.