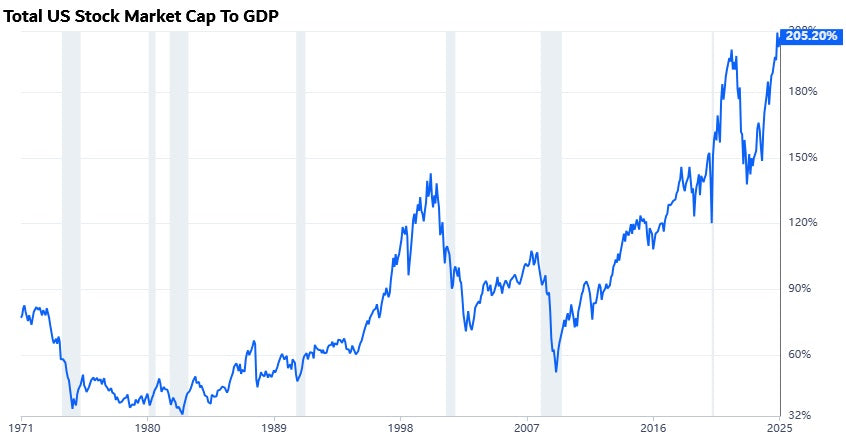

New Record: Stock Market Capitalization To GDP

Published At: Jan 18, 2025 by

Gareth Soloway

Several indicators suggest that the U.S. stock market may be in a bubble. One of the most concerning is the total stock market capitalization to GDP ratio. It currently sits above 200%, an all-time high, surpassing even the dot-com bubble and the 2021 bull market. This metric indicates that U.S. stock valuations are significantly elevated.

Additional factors contributing to these high valuations include:

- Low interest rates: A prolonged period of low interest rates has made borrowing cheaper, encouraging companies to take on debt for activities like stock buybacks, which artificially inflate stock prices.

- Quantitative easing (QE): Central banks injecting money into the economy has increased the money supply, with a portion of this liquidity finding its way into the stock market.

- Global investors: The U.S. stock market is seen as a safe haven, attracting investment from around the world. This influx of foreign capital further pushes up stock prices.

- Retail investor enthusiasm: The rise of commission-free trading apps and social media-driven investment trends has led to a surge in retail investors, many of whom may be inexperienced and overly optimistic.

Potential Consequences of a Bubble

If the market is indeed in a bubble, a correction could have significant consequences:

- Sharp decline in stock prices: A bubble burst could lead to a rapid and substantial decline in stock prices, eroding investor wealth.

- Economic slowdown: A market downturn could negatively impact consumer spending and business investment, potentially leading to an economic slowdown or recession.

- Increased volatility: Market volatility is likely to increase, making investment decisions more challenging.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.