Mastering Topping & Bottoming Tail Signals for Profitable Trading

By:

Verified Investing

Learning to spot tops and bottoms in markets is key to profitable trading. Traders and investors that spot these signals can be on the cutting edge of a high probability move in a stock, crypto, commodity or market.

Below are two of our most used signals and the rules that must be followed.

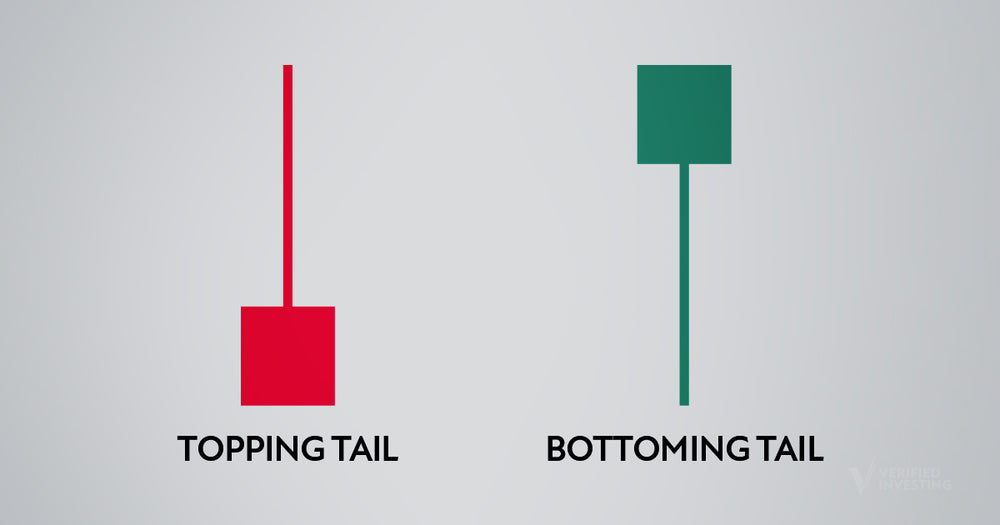

Topping Tail Rules:

- It must occur at a recent high on the chart. The general rule is the highest point in the last 90 candles.

- It must be in the top 10% of volume candles on that particular time frame (90 candles back).

- The candle size from wick (top) to bottom must be in the top 70% of all candles going back those same 90 candles.

- The wick must be at least 50% of the entire candle length.

- The body must be less than 50% of the entire length of the candle.

- The close of the candle must be in the lower 25% of the entire candle (top to bottom)

If you have these factors, then you have a topping tail and a major reversal signal.

Bottoming Tail Rules:

- It must occur at a recent low on the chart. The general rule is the lowest point in the last 90 candles.

- It must be in the top 10% of volume candles on that particular time frame (90 candles back).

- The candle size from tail (bottom) to top must be in the top 70% of all candles going back those same 90 candles.

- The tail must be at least 50% of the entire candle length.

- The body must be less than 50% of the entire length of the candle.

- The close of the candle must be in the top 25% of the entire candle (top to bottom)

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.