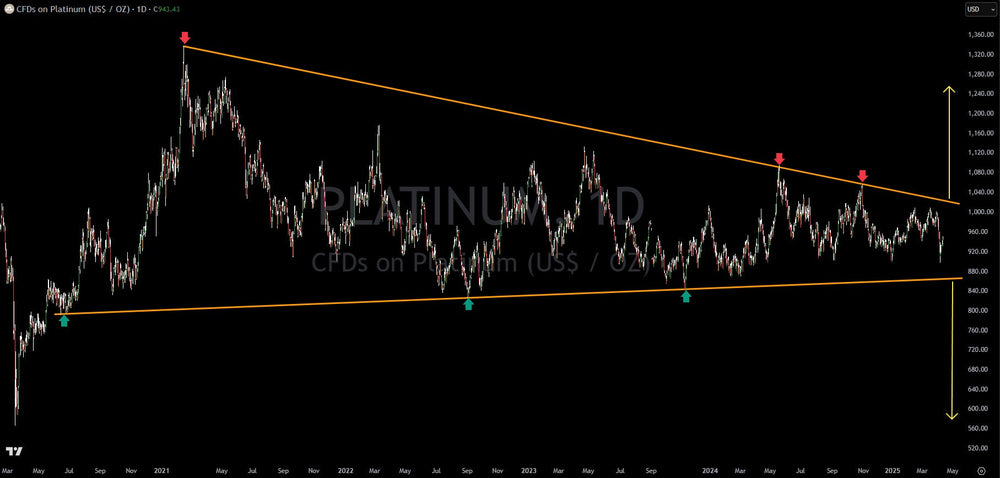

The Wedge Break Trade On Platinum

Since 2021, platinum's price has been characterized by sideways consolidation, carving out a technical pattern known as a wedge. This formation, defined by converging trendlines connecting progressively higher lows and lower highs, indicates market indecision and typically precedes a volatility expansion. Think of it as a spring coiling tighter before releasing.

The critical levels to monitor are $1,020 on the upside and $875 on the downside. A decisive and sustained move above $1,020 would confirm a bullish breakout, potentially initiating a strong uptrend. Conversely, a confirmed break below $875 would signal a bearish breakdown, likely leading to a significant decline.

While underlying factors such as platinum's industrial uses, its rarity, and inflationary pressures from fiat currency printing could support a bullish case, potential macroeconomic headwinds like a recession could curb demand. Ultimately, the chart pattern itself provides the clearest signal; traders should await confirmation of either a breakout or breakdown before committing to a directional bias.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.