Trade Setup: Copper Nears 2 Factor Resistance On Chart

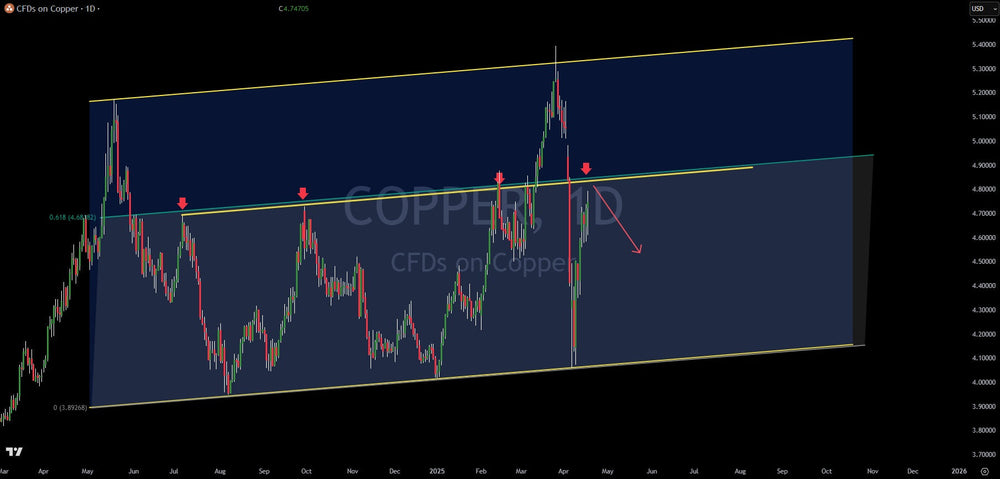

Copper has experienced significant volatility in 2025. After a powerful rally pushed prices from $4.00 to $5.40, the metal saw a sharp retracement to $4.06 before mounting a rebound to its current level around $4.75.

Technical analysis suggests this current move is nearing a critical resistance zone. The highs and lows observed in copper's price action since 2024 appear to form a parallel channel. The current bounce is approaching the 61.8% Fibonacci retracement level of this parallel structure. Adding to the significance, this Fibonacci level coincides with a prominent trend line connecting key prior pivot tops.

This confluence of a major Fibonacci retracement and a significant trend line creates a compelling two-factor resistance setup. This technical alignment signals to commodity traders a potential shorting opportunity around the $4.85 level. Look for the price to potentially test this resistance zone in the coming days, which could trigger significant selling pressure.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.