Bitcoin Technical Analysis: Consolidation Signals Next Move

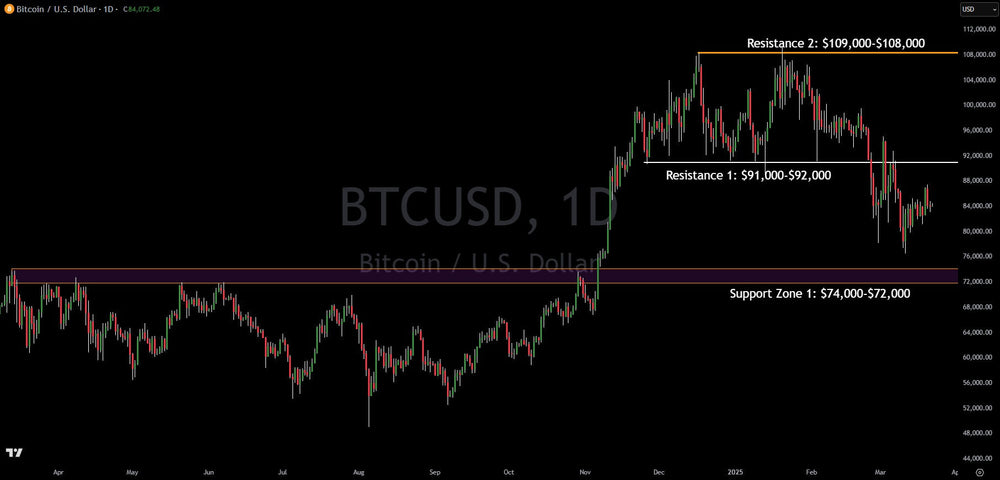

Bitcoin is currently in a consolidation phase, trading between the key support levels of $72,000-$74,000 and the resistance zone of $91,000-$92,000. This consolidation, occurring after a price decline, is technically interpreted as a bearish continuation pattern known as a bear flag. The probability, based on this pattern, favors a move lower, potentially back towards the $72,000-$74,000 support range.

If Bitcoin tests and breaks below the $72,000-$74,000 support area, further downside could be anticipated. There is a minor support level identified around $64,000, but a more significant support level lies lower at $54,000. This $54,000 level would likely be a crucial area to watch if the bearish momentum continues.

Conversely, if Bitcoin were to break decisively above the $91,000-$92,000 resistance zone, the bearish outlook would be invalidated. Such a move could trigger significant upside price action, with the next likely target being a retest of the all-time high, located in the $108,000-$109,000 range.

The current sideways movement and downward pressure on Bitcoin are not happening in isolation. They reflect a broader cautious sentiment within the cryptocurrency market. The initial optimism that followed Trump's inauguration, based on speculation of a more favorable regulatory environment for crypto, appears to have diminished. Market participants are now awaiting new catalysts to provide clear direction, and the absence of immediate positive news is contributing to the current hesitancy.

Furthermore, the observed de-risking in the stock market is adding to the pressure on cryptocurrencies. When traditional markets experience a flight to safety, investors often reduce their exposure to assets perceived as higher risk, and cryptocurrencies, including Bitcoin, typically fall into this category. This interconnectedness between traditional financial markets and the cryptocurrency market is exacerbating the bearish sentiment surrounding Bitcoin's current price action.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.