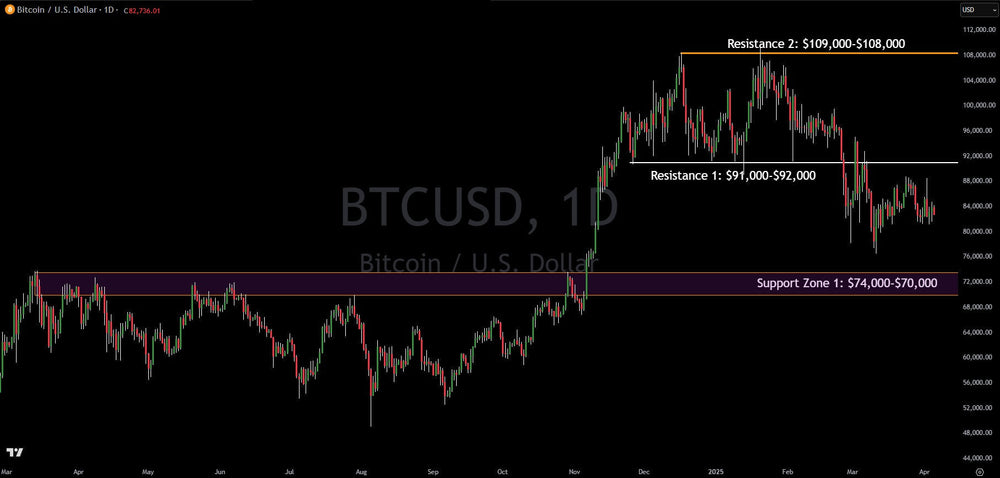

Bitcoin Technical Analysis: Key Trading Levels On Watch

Bitcoin is currently locked in a consolidation phase, fluctuating between significant technical levels. Key resistance is capping upward movement in the $91,000-$92,000 range, while substantial support is found between $70,000-$74,000. At present Bitcoin sits at $83,000, within this defined channel.

A noteworthy development has been Bitcoin's apparent resilience during recent stock market volatility linked to trade policy (tariffs) and a potential weaker economy. While broader equity markets faced downward pressure, Bitcoin maintained a sideways trading pattern. This represents a potential short-term shift in behavior for the leading cryptocurrency, which often exhibits a positive correlation with traditional risk assets like stocks – typically selling off when equities decline.

However, it's crucial to interpret this divergence with caution. Historically, Bitcoin's price movements have sometimes lagged behind those of the stock market. Therefore, observing Bitcoin's performance relative to equities over the coming weeks will be essential to determine if a genuine decoupling is occurring or if this is merely a temporary lag.

Looking ahead, the established support and resistance zones are critical markers. Should Bitcoin break below the current levels and test the $70,000-$74,000 support area, it could signal further downward pressure to $63,000. Conversely, a successful rally pushing through the $91,000-$92,000 resistance would indicate renewed bullish strength, with upside to all-time highs.

Considering its position below major resistance and the historical tendency to correlate with broader market sentiment (despite recent resilience), the immediate outlook retains a slightly cautious or bearish bias, pending a decisive breakout from the current range.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.