Bitcoin Technical Analysis: Near-Term Bullish

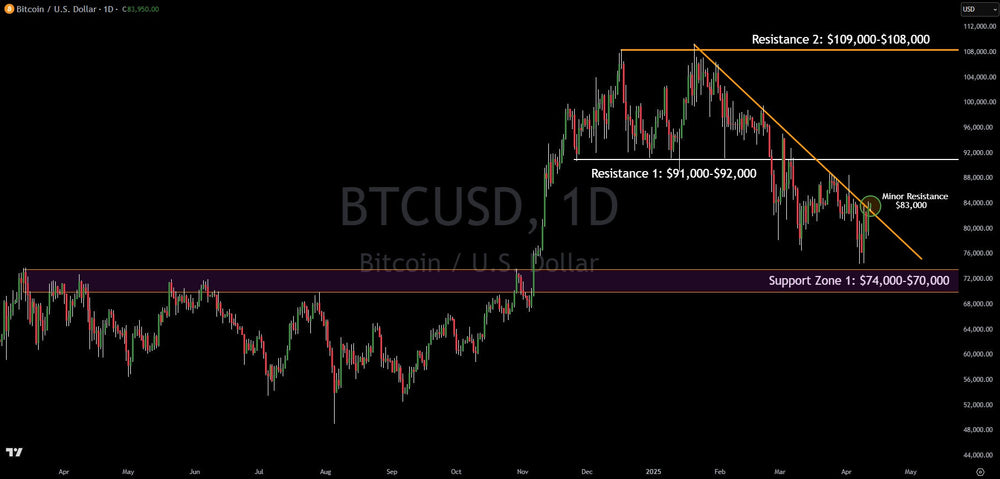

Bitcoin experienced a volatile but ultimately positive week. After dipping towards the significant technical support zone around $74,000, it staged a robust recovery, nearing the $84,000 level. Importantly, this upward move breached the resistance level at $83,000.

Currently, traders are watching closely to see if Bitcoin can consolidate above $83,000, as this breakout remains unconfirmed. A successful hold above this level would strengthen the bullish case, opening the door for potential moves to $88,000 and possibly challenging the major resistance ceiling at $92,000. However, should Bitcoin fail to maintain its position above $83,000, bearish sentiment could prevail, increasing the likelihood of a pullback to the $74,000 support, with $70,000 as a further downside target.

Underlying this price action, two fundamental themes appear prominent:

- First, shifts in the broader financial landscape, including rising US Treasury yields (reportedly driven by trade issues and lower foreign buying) and a weakening US Dollar, may be enhancing Bitcoin's appeal as an alternative store of value, especially amidst questions about traditional financial stability.

- Second, the stabilization and strong performance of the stock market signaled a return of investor confidence and risk appetite. Bitcoin often correlates positively with equity markets during such "risk-on" periods.

In conclusion, the fundamental narrative supporting Bitcoin's long-term value proposition is gaining traction. Near-term price action is bullish but requires careful monitoring of key technical thresholds, particularly the $83,000 level, to confirm the next directional move.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.