Bitcoin Technical Analysis: Probability Still Favors Downside

Bitcoin continues to struggle. After grinding neutral to higher over the last week as the stock market bounced, Bitcoin flushed from as high as $89,000 to below $83,000. This coincided with the stock market dropping sharply on tariff worries, an economic slowdown and inflation. These factors create a general risk-off environment for investors which trigger selling in all risk assets, including Bitcoin.

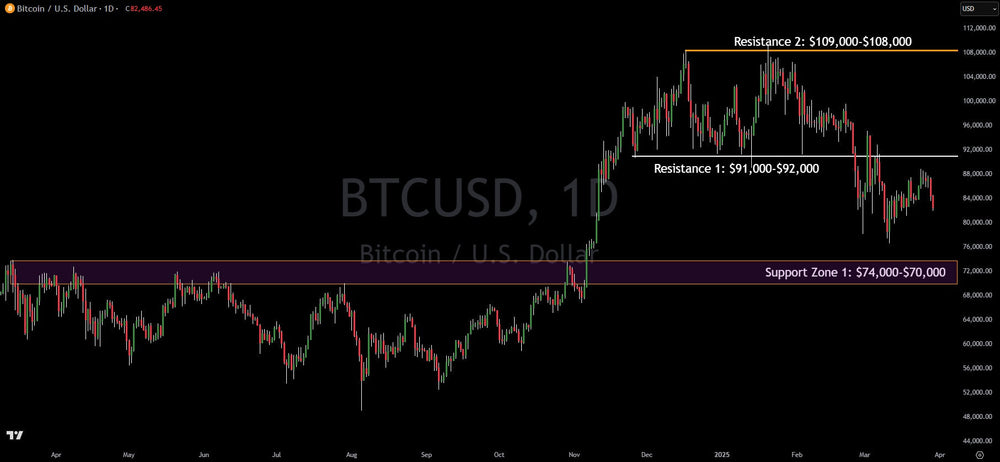

Looking purely at technical analysis on Bitcoin, the biggest cryptocurrency by market cap still holds between major resistance at $92,000 and a major support zone between $74,000 and $70,000.

In technical analysis, it is rare for a major support to not be tested. Since it has not hit $74,000 to $70,000, investors can conclude it is likely to do so in the coming weeks/months. This level will be the first MAJOR test for Bitcoin.

Overall, as long as the stock market keeps selling, it is likely that Bitcoin will as well. This means the near-term is bearish per the data and charts.

Verified Investing is committed to providing investors with purely data-driven analysis. We cut through mainstream media narratives and social media noise, focusing solely on objective charts and data. This rigorous approach empowers us and our members with probability-based trading insights, ultimately aiming to position us as the strategic "house" rather than speculative "gamblers."

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.