Ethereum Technical Analysis: Institutional Insights & Levels

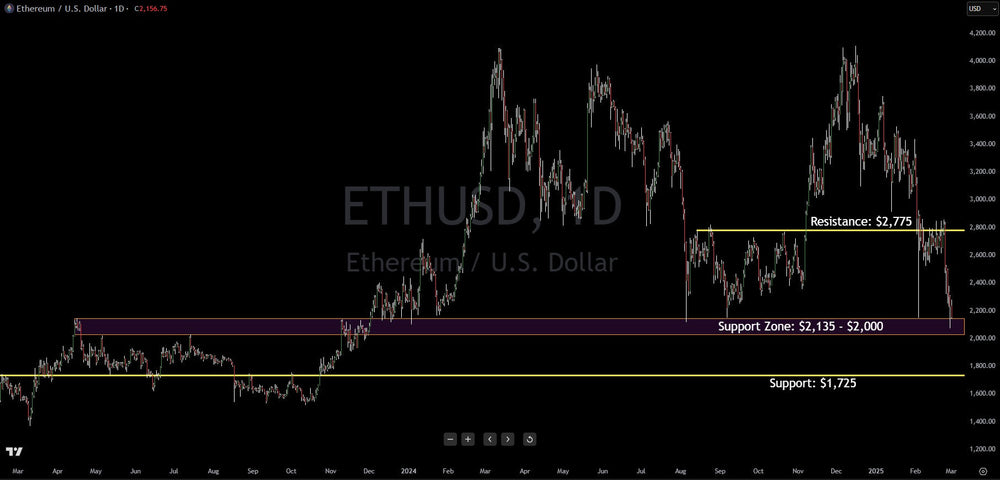

The cryptocurrency market experienced a sharp correction in the past week, with Ethereum (ETH) leading the collapse. After reaching a peak of approximately $2,800, ETH witnessed a significant pullback, plummeting to a low of $2,075.

The primary driver behind this downturn was a widespread "de-risking" sentiment among investors. In times of heightened market uncertainty, assets perceived as high-risk, such as cryptocurrencies, are often the first to be liquidated. This is exacerbated by the relative novelty and complexity of the crypto market, which can contribute to investor anxiety during periods of volatility.

Technical Analysis and Key Support Levels

From a technical perspective, Ethereum has established a critical support zone between $2,135 and $2,000. This area has demonstrated its significance by providing a floor for the recent price drop, resulting in a subsequent bounce. However, the sustainability of this support hinges largely on the broader market's trajectory.

The correlation between the stock market and cryptocurrency performance has become increasingly evident. If the stock market continues its downward trend, it is likely to fuel further panic and accelerate the exodus of capital from the crypto sector, potentially breaching Ethereum's current support.

A decisive break below the $2,000-$2,135 support zone could pave the way for a further decline, with the next significant support level residing around $1,725. This level would likely be tested if a new wave of selling pressure occurs.

The Post-Inauguration Crypto Hangover and the Search for Catalysts

The cryptocurrency market appears to be experiencing a post-inauguration "hangover." The momentum fueled by the anticipation of a new presidential administration, which propelled crypto prices through November and into January, has dissipated. The market is now grappling with a lack of clear catalysts to sustain its previous upward trajectory.

Investors are seeking new narratives and developments to reignite their enthusiasm. Without a compelling story or technological breakthrough, capital may continue to flow into other asset classes perceived as more stable or promising. This highlights the crypto market's reliance on innovation, adoption, and positive regulatory developments to maintain investor confidence.

Looking ahead, a potential breakout above the major resistance level at $2,775 would signal a resurgence in bullish momentum. This level represents a critical hurdle for Ethereum to overcome in its quest to regain its upward trajectory.

Data-Driven Investing: A Path to Success

In navigating the volatile cryptocurrency market, a data-driven approach is paramount. Verified Investing emphasizes the importance of relying on pure data, technical analysis, and institutional-level insights. This methodology minimizes the influence of emotions, biases, and hype, enabling investors to make informed decisions based on objective analysis.

By prioritizing data and probabilities, investors can enhance their chances of success in the complex and dynamic world of cryptocurrency investing. This approach fosters a disciplined and strategic mindset, essential for navigating the inherent risks and opportunities of the market.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.