Institutional Technical Analysis On Bitcoin

Bitcoin is currently experiencing a significant pullback, trading approximately 22% below its recent all-time high. This downturn can be attributed to a combination of factors, primarily a lack of fresh positive catalysts and a broader market de-risking trend.

Following the initial enthusiasm surrounding President Trump's election and the anticipation of a potentially crypto-friendly administration, the market has entered a period of relative quiet on the regulatory and macroeconomic fronts specific to cryptocurrency. This absence of new, compelling narratives has left Bitcoin and the wider crypto market in a state of limbo. Without a clear catalyst to reignite bullish sentiment, investors appear hesitant to aggressively buy in, contributing to the current sideways or downward price action.

Adding to this pressure is a significant de-risking trend observed in traditional markets. The S&P 500's recent 10% correction within a single month has heightened investor concerns about exposure to risk assets across the board. In times of market uncertainty and volatility, investors often reduce their holdings in assets perceived as higher risk, and cryptocurrencies like Bitcoin are frequently among the first to be trimmed. This correlation between traditional market jitters and crypto sell-offs is a key factor weighing on Bitcoin's price.

Despite consistent buying activity from proponents like Michael Saylor, the confluence of these negative forces has made it challenging for Bitcoin to sustain its record highs.

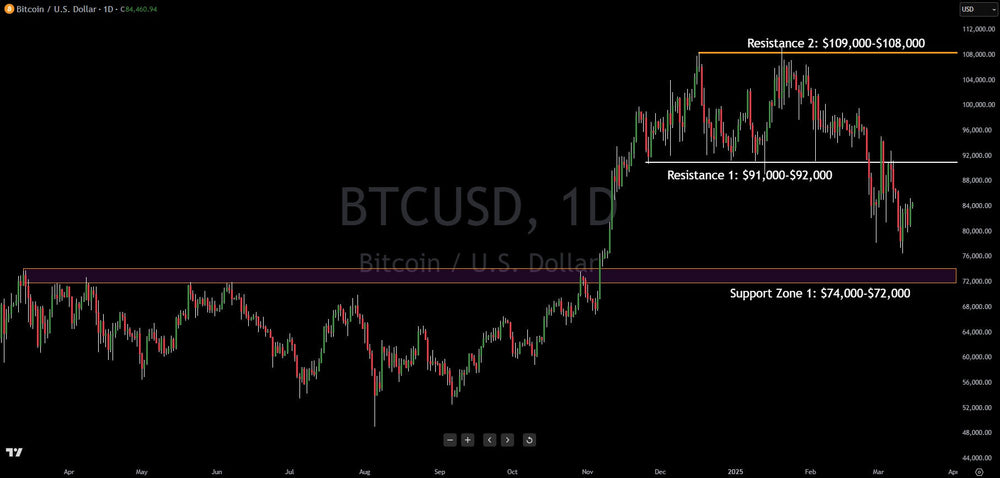

Looking ahead, Bitcoin's price action will likely be influenced by its ability to hold key support levels and overcome upcoming resistance. On the downside, a significant support zone exists between $72,000 and $74,000. A break below this level could signal further weakness. Conversely, should Bitcoin attempt a rally, it will encounter strong resistance in the $91,000 to $92,000 range. Successfully breaching this resistance would be a bullish signal.

Mid-Term Outlook:

The mid-term bias for Bitcoin appears to be leaning towards weakness. The continued uncertainty in the stock market and the resulting cautious sentiment among investors pose significant risks. Until a new positive catalyst emerges for the crypto market or the de-risking trend in broader markets subsides, Bitcoin may continue to face challenges in regaining its upward momentum. Investors should closely monitor both crypto-specific developments and broader market indicators to gauge the potential direction of Bitcoin's price action.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.