Institutional Technical Analysis On Ethereum

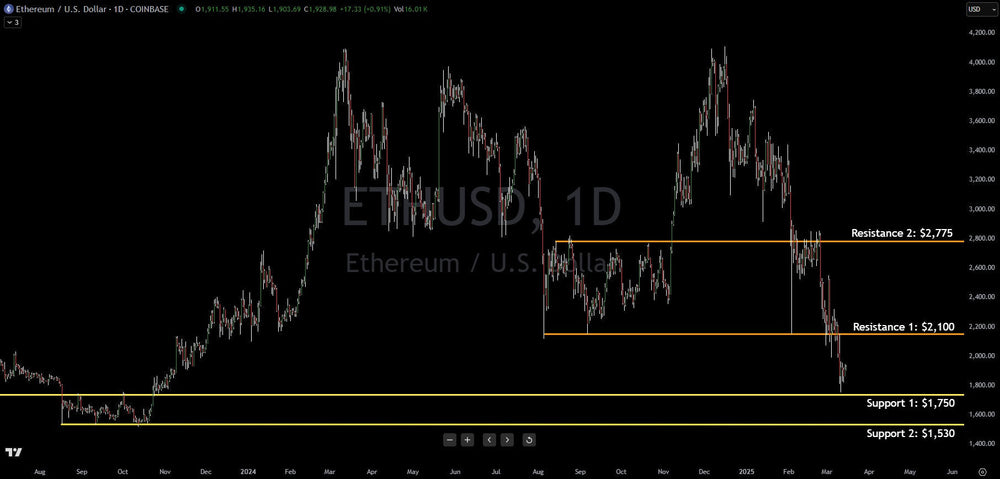

Ethereum has continued its recent downtrend, reaching a new 52-week low of $1,750 in the past week. This price level marks a return to levels last seen in October 2023, highlighting the significant bearish pressure the cryptocurrency is currently facing.

The broader cryptocurrency market continues to grapple with a lack of positive catalysts. The initial enthusiasm surrounding President Trump's inauguration and the anticipation of a crypto-friendly SEC chair appears to have waned, shifting market focus back to fundamental valuations. This shift coincides with a significant downturn in the stock market, triggering a wave of de-risking across various asset classes, including cryptocurrencies.

Technical Analysis Points to Key Levels

A significant technical development in the past week was a support-resistance flip at the $2,100 level. This price point, which had acted as a support level for over a year, was breached and is now functioning as resistance. Should Ethereum manage to reclaim and confirm its position above $2,100, a potential rally towards the $2,775 mark could materialize. This target aligns with previous resistance levels and could represent a significant recovery.

On the downside, Ethereum successfully tested the crucial $1,750 support level. This level will be critical to watch in the coming days. A break below $1,750 could open the door for further declines, with the next significant support level residing around $1,530. This represents a substantial potential drop, underscoring the importance of the $1,750 level holding.

Near-Term Bounce Possible, Mid-Term Outlook Cautious

In the immediate short term, a bounce from the $1,750 support level appears likely. Price action may see a rally towards retesting the newly established resistance at $2,100. Traders should monitor the strength of this potential bounce and whether Ethereum can overcome the $2,100 hurdle.

However, the mid-term outlook for Ethereum remains cautious. The prevailing weakness in the stock market is likely to continue exerting downward pressure on the cryptocurrency space. Unless the stock market finds a底 (bottom) and stabilizes, significant and sustained buying pressure in Ethereum and the broader crypto market is expected to be limited to short-covering rallies and technical bounces. Investors should remain vigilant and monitor both cryptocurrency-specific developments and broader macroeconomic factors influencing market sentiment.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.