Technical Analysis: Bitcoin Trading Levels And Insights

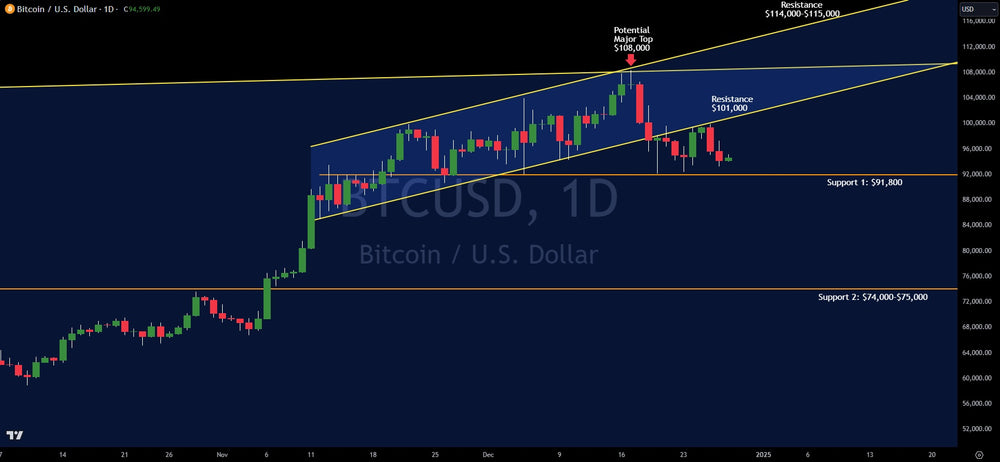

Bitcoin is trapped in a precarious "megaphone" pattern, characterized by widening price swings between two diverging trend lines. This formation, occurring after a sharp drop from $108,000 to $91,800, suggests a heightened risk of further downside.

Despite MicroStrategy's continued accumulation of Bitcoin, selling pressure has dominated recently, pushing the price towards the crucial $91,800 support level. A break below this level could trigger a significant decline, with limited support until the $74,000-$75,000 zone.

The upper trendline of the megaphone pattern, currently around $101,000, acts as immediate resistance. Overcoming this hurdle would bring the $108,000 pivot top back into focus. Only a decisive move above $108,000 would signal a potential shift in momentum, opening the door for a rally towards $114,000-$115,000.

Interestingly, Bitcoin's recent price action appears to be closely correlated with the Nasdaq's performance, with sharp declines in the tech-heavy index coinciding with Bitcoin's own downward moves. This suggests that overall investor sentiment and risk appetite, rather than developments within the crypto space itself, are currently the dominant drivers of Bitcoin's price.

Key Takeaways:

- Bitcoin's "megaphone" pattern hints at further downside risk.

- $91,800 is a critical support level to watch.

- Breaking above $108,000 is crucial for a sustained rally.

- The Nasdaq's performance is a key factor influencing Bitcoin's price.

While the near-term outlook for Bitcoin appears cautiously bearish, the long-term bullish trend remains intact. This rewrite aims to provide a more concise and engaging analysis while emphasizing the key technical levels and potential risks.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.