Technical Analysis: Data Driven Insights Into Ethereum

Cryptocurrency Ethereum is currently facing headwinds and demonstrating signs of weakness in the market. Several factors appear to be contributing to this downward pressure. Firstly, the landscape of blockchain technology is becoming increasingly competitive, with the emergence of alternative layer-1 protocols and scaling solutions vying for market share and developer attention. This increased competition can dilute Ethereum's dominance and impact its price.

Secondly, the broader macroeconomic environment plays a significant role. The current struggles in the traditional stock market, characterized by a "risk-off" sentiment, are clearly impacting investor appetite for riskier assets like Ethereum. When investors become more risk-averse, they tend to move capital away from volatile assets, including cryptocurrencies, and towards safer havens. This correlation is evident in Ethereum's current trading range near its 52-week lows. Should the stock market experience further declines, it is reasonable to anticipate continued downward pressure on Ethereum's price.

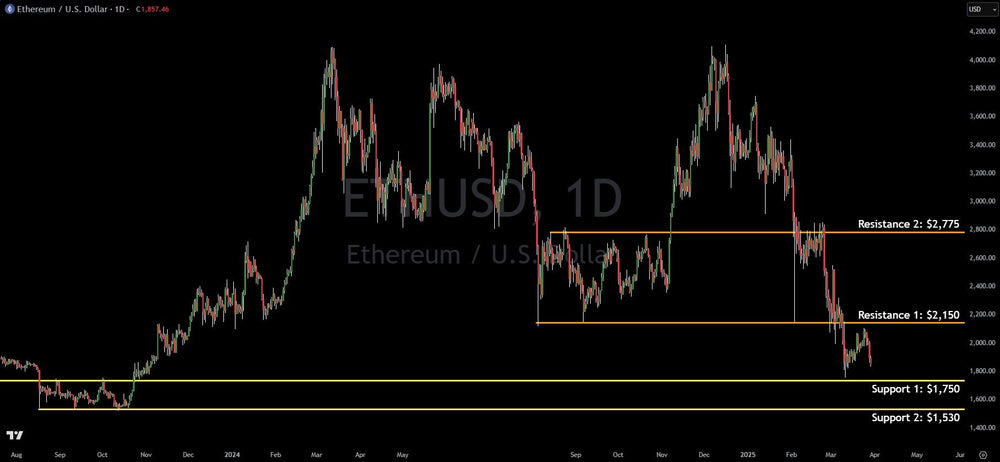

From a technical analysis perspective, Ethereum is currently trading within a defined range between a resistance level at approximately $2,150 and a support level around $1,750. This suggests a period of consolidation. While a near-term breakout above the $2,150 resistance level is considered less probable given the current market conditions, such a move could potentially trigger a significant rally towards the $2,750 mark. This target likely represents the next significant level of resistance or a previous high.

However, the more likely scenario, based on the prevailing market sentiment and technical indicators, points towards further downside. If Ethereum breaks below the crucial support level of $1,750, it could trigger a significant sell-off, potentially pushing the price down to the next identified support level around $1,530. This level likely represents a previous low or an area of significant trading volume.

Verified Investing has one goal, to give investors purely data driven analysis. We ignore the mainstream media narratives, the social media hype and focus on the charts and data. This gives us and our members probability based trades. Ultimately, the goal is to be the casino, not the gambler.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.