Chart Analysis: U.S Dollar Bounce Almost Complete, Downside Likely

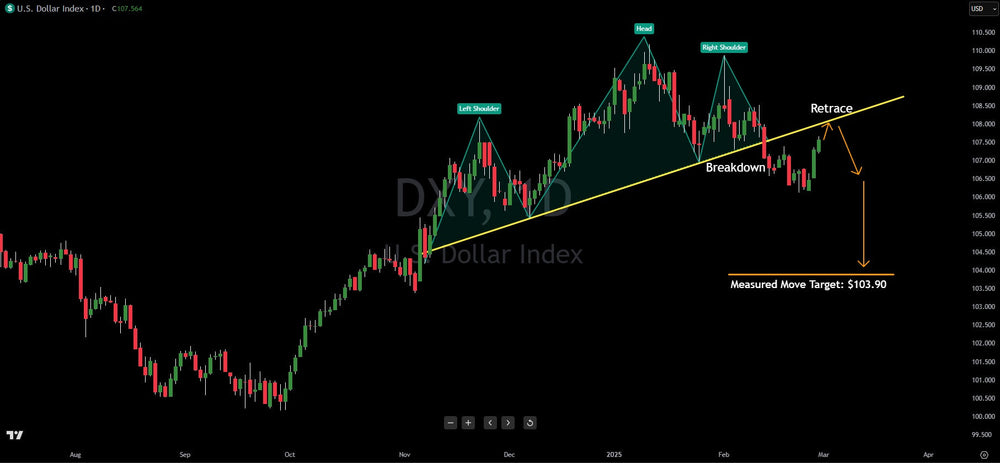

The U.S. Dollar Index (DXY), a key measure of the dollar's value against a basket of major currencies, has exhibited a classic head and shoulders pattern, a technical formation widely recognized as a bearish indicator. This pattern, characterized by a peak (the 'head') flanked by two lower peaks (the 'shoulders'), with a 'neckline' connecting the troughs, suggests a potential reversal of the dollar's upward trend.

Recently, the neckline of this head and shoulders pattern was breached, triggering the bearish signal. However, as is often observed in technical analysis, the dollar experienced a short-term rebound last week. This bounce is not necessarily indicative of a trend reversal but rather a common phenomenon known as a retracement or 'throwback.'

In the context of a broken head and shoulders pattern, this retracement often sees the price action revisit the former neckline, which previously acted as support. Once broken, this level typically transforms into resistance, creating what traders colloquially refer to as the 'scene of the crime.' This retracement serves as a test of the newly established resistance, and its failure to decisively break above this level reinforces the bearish outlook.

Specifically, the DXY's recent bounce appears to be a retest of the broken neckline. If the dollar fails to maintain its upward momentum and turns lower from this resistance level, it would confirm the validity of the head and shoulders pattern and suggest a resumption of the downtrend.

The calculated target for this bearish pattern is approximately $103.90. This target is derived by measuring the vertical distance between the head and the neckline and projecting that distance downwards from the breakdown point. This projected target provides a potential downside objective for traders and investors monitoring the DXY.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.