The EUR/USD Is Retracing After Its Breakout, Here Is The Trade

The Euro (EUR) has shown notable strength against the US Dollar (USD) recently, culminating in a significant technical breakout on the EUR/USD daily chart. After a prolonged period of consolidation within a large wedge pattern, the pair has decisively broken to the upside, suggesting a potential major trend shift. While a near-term pullback is currently underway, technical analysis points towards higher future targets, supported by evolving fundamental dynamics weighing on the Dollar and favoring the Euro.

Technical Analysis: Breaking the Wedge

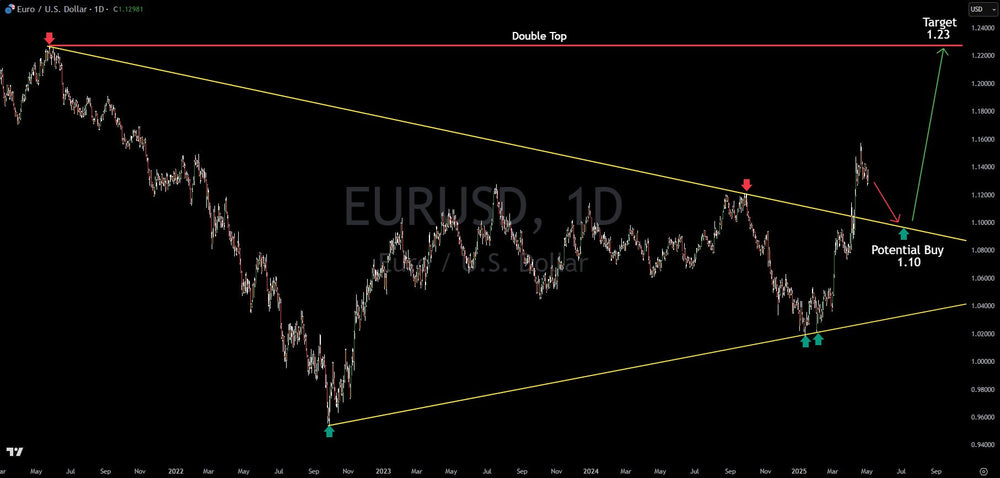

Observing the provided daily chart, the EUR/USD pair spent a considerable amount of time, potentially spanning from late 2021/early 2022 into early 2025, coiling within a symmetrical wedge or triangle pattern. This pattern, marked by converging upper and lower trendlines, typically represents a period of market indecision and consolidation before a significant directional move.

Recently, bulls took control, driving the price firmly above the upper resistance trendline of this wedge. This breakout signals a potential end to the previous downtrend or consolidation phase and the beginning of a new upward trajectory.

Following such breakouts, it's common for prices to retrace and test the former resistance level, which now ideally acts as support. The chart highlights this critical area, labeled "Potential Buy 1.10," referring to the breakout level as the 'scene of the crime'. This retest offers traders an opportunity to assess the validity of the breakout; if support holds around the 1.1000 level, it would strengthen the case for further upside.

Should the breakout prove durable and support hold near 1.1000, the chart identifies a clear upside objective: the Target 1.23. This level corresponds to a significant previous high, likely from early 2022. Reaching this level would complete a large "Double Top" pattern relative to that earlier peak, representing a substantial potential gain from the potential buy zone.

Fundamental Backdrop: Why the Euro is Gaining Ground

The technical breakout isn't occurring in a vacuum. Several fundamental factors are contributing to the Euro's strength relative to the US Dollar:

- US Trade Policy Uncertainty: Increased rhetoric and potential implementation of US tariffs against major trading partners, including the European Union, China, Mexico, and Canada, have created significant market uncertainty. Fears of higher import costs, disrupted supply chains, and slower US economic growth are weighing on the Dollar. When uncertainty stems directly from US policy, the Dollar's traditional safe-haven appeal can diminish.

- US Economic Concerns & Fed Policy: Signs of strain are appearing in the US economy, with concerns about inflation potentially remaining sticky while consumer spending shows signs of weakness. Markets are increasingly pricing in multiple interest rate cuts by the Federal Reserve throughout 2025. Lower interest rates generally make a currency less attractive to foreign investors, contributing to USD weakness.

- European Initiatives & Growth Prospects: In contrast, Europe is benefiting from significant fiscal initiatives. Germany's substantial €500 billion infrastructure investment plan and a broader EU push for increased defense spending (cited as an €800 billion boost) are expected to support economic growth and confidence in the Eurozone.

- Narrowing Interest Rate Differentials: As the Fed looks towards easing policy, while the European Central Bank (ECB) is perceived as remaining relatively less accommodative (even if it also cuts rates, the expectation might be for fewer or smaller cuts than the Fed), the interest rate advantage previously held by the Dollar is shrinking. This shift encourages capital flows towards the Euro.

- Improved Eurozone Current Account: After slipping into deficit largely due to high energy import costs, the Eurozone's current account balance has returned to surplus, which typically lends support to the currency.

Outlook: Retest Offers Opportunity

The confluence of a clear technical breakout from a major pattern and a fundamental narrative favoring Euro strength (or Dollar weakness) presents a compelling picture for EUR/USD bulls. The current pullback towards the 1.1000 breakout zone ('scene of the crime') is a critical juncture. If this level holds as support, it could confirm the bullish momentum and set the stage for a move towards the 1.23 double top target in the medium term. However, a decisive failure to hold this support would question the validity of the initial breakout.

Traders will be closely watching the price action around 1.1000, alongside incoming economic data and developments regarding US trade policy and central bank actions, to gauge the potential for the next major leg higher in EUR/USD.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.