U.S. Dollar (DXY) Technical Analysis: Dollar Expected To Weaken More

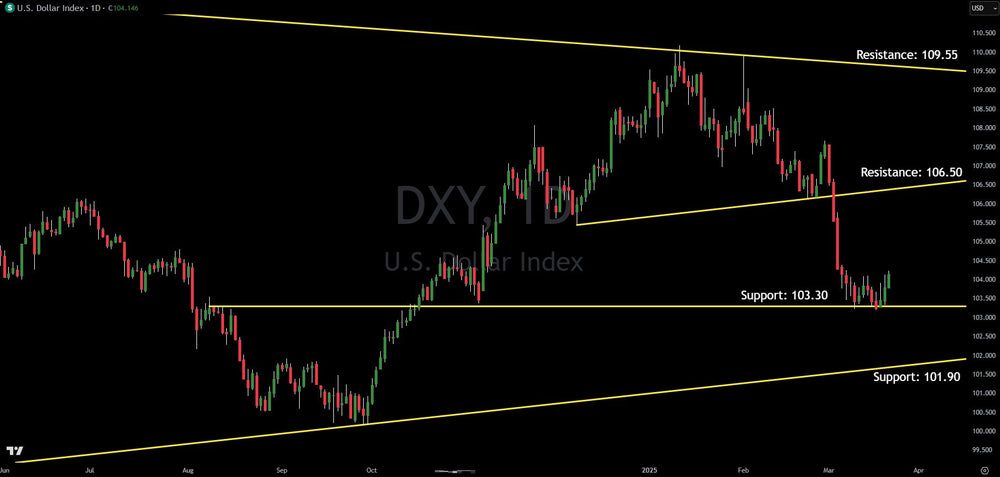

The U.S. Dollar Index (DXY) has exhibited a modest recovery in recent trading sessions, primarily driven by the retest of a significant support level around 103.30. This price point not only represents a key area of historical buying interest but also coincided with the completion of a previously identified head and shoulders pattern, where the bearish target was successfully reached. Given this confluence of technical factors, a short-term bounce was a probable outcome and could persist in the immediate future.

While the recent bounce offers a temporary reprieve, the overarching outlook for the U.S. Dollar suggests a potential shift towards a longer-term downtrend. However, in the short-term, further upward movement is still plausible as a bear flag forms. The next significant resistance level to watch on the upside is around 106.50. This area could present a challenge for any sustained bullish momentum.

Conversely, should the DXY fail to hold the 103.30 level and break decisively below it, the next major technical support to anticipate on the downside resides near 101.90. A move below this level would likely reinforce the bearish sentiment and potentially accelerate further declines.

Several fundamental headwinds are currently weighing on the U.S. Dollar's prospects. Elon Musk is implementing cutbacks to the U.S. government through DOGE, which will likely have implications for economic activity. Furthermore, the U.S. economy is showing signs of deceleration, with many consumers already feeling the strain from persistent high inflation. As the U.S. economic outlook softens, other global economies appear to be gaining traction, potentially leading to a relative strengthening of their currencies against the U.S. Dollar.

Specifically, Europe is increasing its military spending, which is projected to provide a substantial boost to its GDP. This increased economic activity could translate to a stronger Euro. Additionally, there are indications that China may be emerging from its recent economic slowdown. A recovery in the Chinese economy could bolster the Renminbi (Yuan) and exert further downward pressure on the U.S. Dollar as investors seek opportunities in potentially higher-growth markets. These combined factors suggest a challenging environment for the U.S. Dollar in the medium to long term.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.