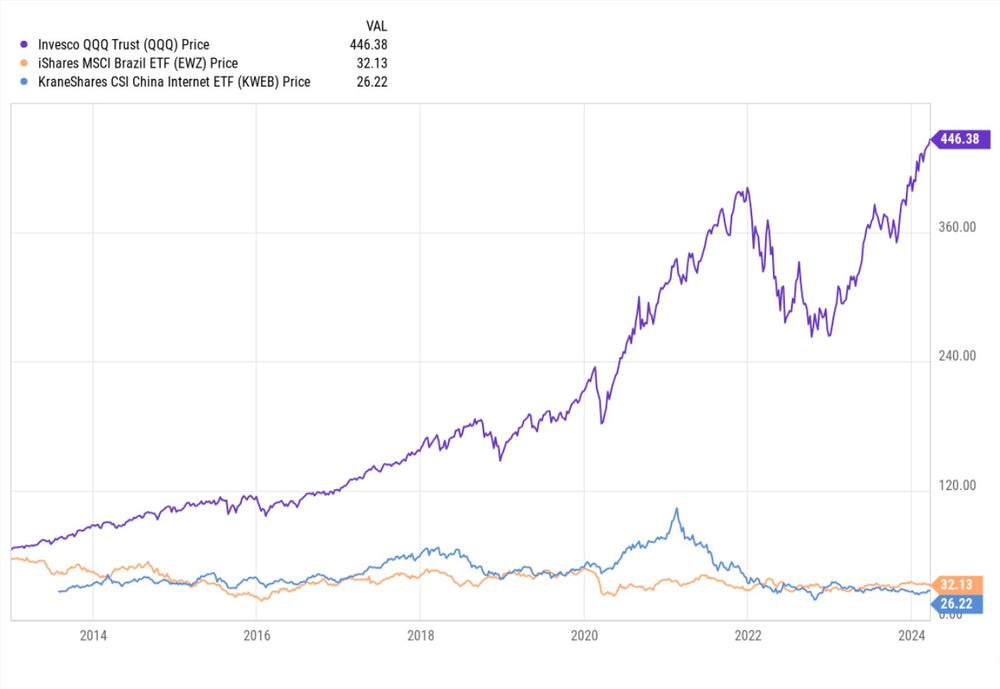

US Equity Valuation At All-Time High vs. China And Brazil

US stocks continue to be the favored investment for domestic and global investors. This gets intriguing if there is a reversion to the mean where foreign markets like Brazil and China play catch-up and US stocks see a pullback. In the chart, note the dramatic disparity. For example, US stock markets like the NASDAQ and S&P continue to make all-time highs while China and Brazil have not made all-time highs in over a decade.

The reversion trade with China and Brazil leading would likely occur if the US has a hard landing and inflation continues to uptick, handcuffing the Federal Reserve from lowering rates aggressively.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.