Don't Be Fooled: Energy Masks Persistent Inflation Pressure

Written By Gareth Soloway, Chief Market Strategist at VerifiedInvesting.com

The latest Producer Price Index (PPI) numbers have the markets breathing a sigh of relief, but as traders, we need to look beyond the headlines. What's really happening here? Let's unpack the March 2025 PPI data in detail and uncover what's actually brewing beneath the surface.

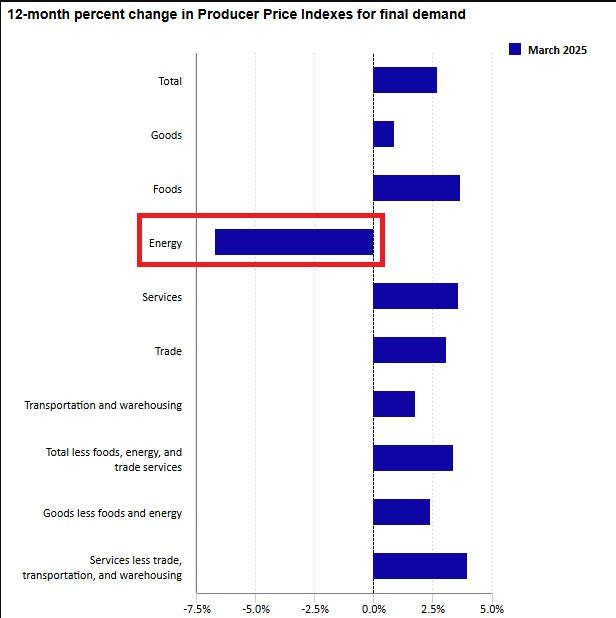

When I first saw the PPI coming in below expectations, I immediately suspected something was masking the true inflation picture. Sure enough, after diving into the components, it becomes crystal clear – energy's steep decline is creating an optical illusion of moderating inflation that simply doesn't reflect reality for most sectors of the economy.

The Energy Anomaly

Take a good look at that energy component in the chart – down approximately 5% year-over-year. This massive deflationary force in energy is essentially dragging down the overall index, creating what I call a "false floor" for the broader PPI reading. The market's initial positive reaction makes sense on the surface – lower producer prices should theoretically mean less inflation pressure flowing through to consumers, right?

Not so fast.

What many traders miss is that energy prices are among the most volatile components in the index. They can swing dramatically from month to month based on geopolitical tensions, production decisions, weather patterns, or even temporary supply chain disruptions. I've seen energy prices reverse course within weeks countless times throughout my 26 years of market analysis.

This steep energy decline is essentially throwing a wet blanket over what would otherwise be an alarmingly hot inflation reading. Remove that anomaly, and the picture changes dramatically.

The Inflation Reality for Consumers

Looking across the other categories tells the real story here. Foods up around 4%, services climbing approximately 4.5%, and trade advancing about 3.5% – these are significant inflationary pressures that directly impact consumers' daily lives.

The "Total less foods, energy, and trade services" – which economists often look at for underlying trend – is showing a solid 3-4% rise. That's substantially above the Federal Reserve's 2% target and suggests core inflation remains persistently high despite all the monetary tightening we've seen.

Here's what this means for the average American: While they might get some temporary relief at the gas pump, they're still facing higher costs almost everywhere else – at the grocery store, when paying for services, and in their day-to-day expenditures. This divergence creates a psychological disconnect where consumers hear about "improving inflation" but don't feel it in their wallets.

The Tariff Time Bomb

There's another critical factor the market is completely overlooking in this data: the tariff effect. Many companies anticipated the implementation of new tariffs and strategically built up massive inventory stockpiles ahead of time. This pre-tariff buying spree has temporarily insulated consumers from price increases.

But here's the kicker – that inventory cushion won't last forever. In fact, I'm estimating that most companies will deplete these stockpiles within the next 2-3 months. When that happens, we're likely to see a sudden and potentially sharp acceleration in prices across multiple categories as the full impact of the tariffs finally works its way through the supply chain.

This creates what I call a "delayed inflation trigger" – a compression of price increases that, once released, could catch both consumers and investors off guard.

Corporate Confirmation

Need evidence beyond the data? Look no further than Walmart, America's largest retailer and the ultimate barometer for consumer economic health. During their latest earnings call, executives specifically mentioned they would be raising prices due to persistent inflation pressures.

When a price leader like Walmart – a company known for its relentless focus on "everyday low prices" and with massive purchasing power – signals price increases, you'd better believe inflation remains entrenched in the system.

Trading Implications

So what does this mean for your portfolio? First, don't get caught in the short-term market optimism around this PPI report. The relief is likely temporary, and positions based solely on "peaking inflation" could be vulnerable to a reality check in the coming months.

Second, sectors with pricing power and those that benefit from persistent inflation still deserve close attention. The financials, consumer staples with strong brands, and select commodities outside of energy could outperform as the true inflation picture reasserts itself.

Third, be extremely cautious with long-duration assets like growth stocks and long-term bonds. If the market suddenly realizes that core inflation remains stubborn, we could see a rapid repricing of interest rate expectations that would hit these assets particularly hard.

The Technical Picture

Looking at the year-over-year percentage changes across sectors, we're seeing what technicians might call a "divergence" – where one component moves in the opposite direction of the broader trend. These divergences rarely persist long-term and often resolve by returning to the primary trend.

In this case, I'd expect energy prices to eventually move back toward the inflationary pattern we're seeing in other sectors, rather than the other sectors joining energy in deflationary territory. Historical patterns suggest energy's negative reading is more likely the outlier than the new norm.

The Fed's Dilemma

This data puts the Federal Reserve in an incredibly difficult position. The headline numbers give them room to consider rate cuts, but the underlying components suggest inflation remains far too high to justify significant easing. This divergence will likely lead to continued market volatility as traders try to predict the Fed's next move with incomplete information.

I've watched the Fed navigate these crosscurrents for decades, and one thing remains constant – they tend to err on the side of caution when inflation signals are mixed. This suggests they'll likely maintain higher rates longer than the market currently expects, creating potential disappointment for those anticipating aggressive rate cuts in 2025.

Conclusion: Look Beneath the Surface

As traders and investors, our job is to see what others miss. This PPI report is a perfect example of why headline numbers alone can lead you astray. While markets cheer the "better-than-expected" data, the underlying reality points to persistent inflation pressure that will likely reassert itself in the coming months.

The combination of stubborn core inflation, depleting pre-tariff inventories, and signals from major retailers like Walmart creates a potent cocktail for inflation surprises in the second half of 2025. Position accordingly.

Remember, the market often lulls participants into complacency right before the biggest moves occur. This moment of inflation optimism might just be the calm before the storm.

Stay vigilant,

Gareth Soloway Chief Market Strategist VerifiedInvesting.com

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.