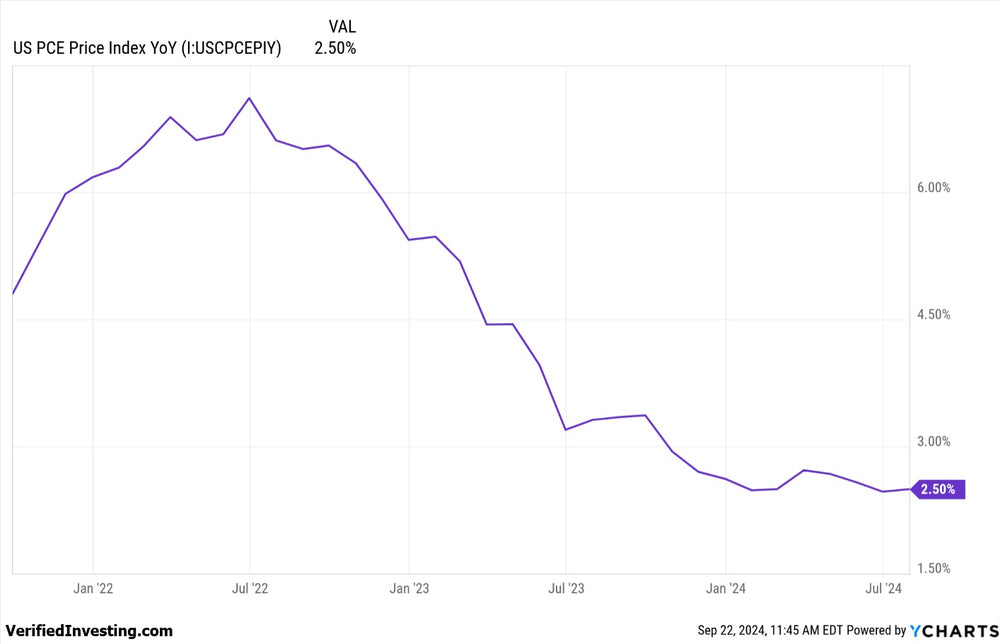

Exploring The Inflation PCE Data And Why It Is Fed Favored

What is PCE?

The Personal Consumption Expenditures (PCE) price index is a measure of inflation that tracks the changes in prices of goods and services purchased by consumers in the United States. It's calculated by the Bureau of Economic Analysis (BEA). There are two main versions:

- Headline PCE: Includes all goods and services.

- Core PCE: Excludes volatile food and energy prices, providing a clearer picture of underlying inflation trends.

Why the Federal Reserve Favors PCE:

The Federal Reserve, the central bank of the U.S., has a dual mandate of promoting maximum employment and price stability. To achieve the latter, it closely monitors inflation and uses the PCE price index as its preferred gauge for several reasons:

-

Broader Coverage: PCE includes a wider range of goods and services than other inflation measures, such as the Consumer Price Index (CPI). This gives a more comprehensive picture of consumer spending patterns and price changes.

-

Flexibility: PCE accounts for consumer substitution behavior. When prices of certain goods rise, consumers may switch to cheaper alternatives. PCE reflects these shifts, providing a more accurate measure of actual inflation experienced by consumers.

-

Revisions: PCE data is subject to revisions as new information becomes available. This ensures that the data remains up-to-date and reflects the most accurate picture of inflation.

-

Focus on Core PCE: The Federal Reserve pays close attention to Core PCE, as it strips out the volatile food and energy prices that can cause short-term fluctuations in the headline PCE. This helps them focus on underlying inflation trends and make more informed policy decisions.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.