Housing Inventory Explosion Signals Deep Market Stress

We've reached a pivotal moment in the housing market, and frankly, the charts are telling a story most analysts aren't prepared to discuss. Looking at the latest housing inventory data, we're witnessing something that hasn't happened in over a decade—a dramatic surge in available homes that's exposing the fundamental weakness beneath the surface of America's housing market.

The Numbers Don't Lie

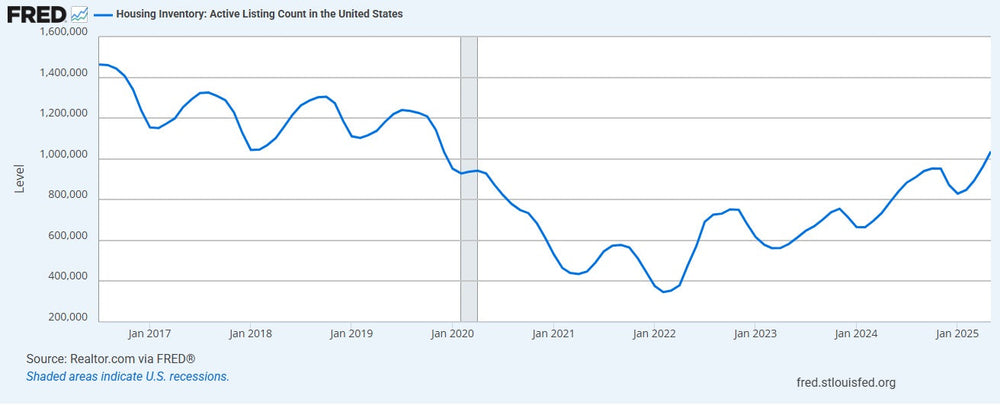

Housing inventory has exploded by nearly 27% compared to last year, with over 682,000 single-family homes now sitting on the market. To put this in perspective, we've gone from the severe shortage lows of 300,000-400,000 units during the pandemic era to approaching the 1,000,000 level we haven't seen since before the housing disruption began.

This isn't just a seasonal adjustment or a minor market correction. We're finishing three full years of rising inventory, and 2025 is poised to continue this trend. When inventory builds consistently for multiple years, it signals that the fundamental supply-demand equation has shifted, and not in favor of sellers.

Behind the Inventory Surge: A Perfect Storm of Economic Pressure

The inventory explosion isn't happening in a vacuum. It's the direct result of multiple economic forces converging to create conditions that are pricing out ordinary Americans from the housing market.

The Mortgage Rate Reality

Mortgage rates have climbed back above 7% for the first time since May 2024, despite the Federal Reserve's attempts to provide relief through rate cuts. Most economists now expect mortgage rates to remain elevated between 6.5% and 7% throughout 2025, creating a sustained affordability crisis.

The math is brutal for potential buyers. With mortgage rates at 7%, only 31.5 million households can afford a median-priced home at $459,826, requiring a household income of $147,433. Each quarter-point increase in rates pushes approximately 1 million additional households out of the market entirely.

The Insurance Crisis Accelerates

Homeowners insurance premiums have increased 8.7% faster than the rate of inflation from 2018-2022, but the situation has deteriorated significantly in 2024 and 2025. Some states are experiencing insurance premium increases of up to 27%, with the national average projected to rise 8% to $3,520 annually.

A recent survey found that 47% of people who attempted to buy or sell a home in 2024 experienced difficulty with home insurance, and 12% actually backed out of deals because of insurance costs. When insurance becomes a deal-breaker rather than just another cost of homeownership, you know the market has fundamentally changed.

Property Tax Pressure Mounts

The median single-family property tax bill has risen by 24% as real estate values surged 40% between 2019 and 2023. These aren't small adjustments—they represent hundreds of additional dollars per month for many homeowners, further eroding affordability for both existing owners and potential buyers.

The Hidden Costs of Homeownership

Beyond the obvious costs of mortgage payments, insurance, and taxes, there's another factor that's often overlooked: the rising cost of simply maintaining a home. Construction industry labor shortages have created extreme pressure on repair and maintenance costs, with 368,000 construction job openings in August 2024—more than double what the Bureau of Labor Statistics expected.

Rising construction costs mean it costs more to repair or rebuild homes, with materials prices continuing to climb due to supply chain disruptions and tariff pressures. Every time something breaks in a house—from a roof leak to a broken HVAC system—homeowners are facing costs that have increased dramatically from just a few years ago.

Economic Uncertainty Compounds the Problem

Economic indicators present mixed signals regarding an impending recession, with global trade tensions, consumer debt levels, and geopolitical events contributing to economic uncertainty. This uncertainty is creating a psychological barrier for potential buyers who might otherwise stretch to afford a home.

Higher unemployment and economic uncertainty make it more challenging for households to commit to taking on a mortgage, even if rates fall. When people are worried about their jobs or the broader economy, they naturally become more conservative with major financial decisions.

The Lock-In Effect Meets Reality

For years, we've discussed the "lock-in effect"—existing homeowners reluctant to sell because they'd lose their low mortgage rates. As of the second quarter of 2024, nearly 86% of homeowners with mortgages had interest rates below 6%, though that share is down from 93% two years ago.

But now we're seeing a different dynamic. The bulk of 2025's inventory is likely coming from homeowners who need to sell—not those who have the luxury of timing their sale. This includes people divorcing, moving for new jobs, having kids, getting married, and other significant lifestyle milestones.

These life circumstances are forcing sales regardless of market conditions, contributing to the inventory build-up we're seeing.

Regional Variations Tell the Story

Nine states now have home prices at or below 2024 levels, including major markets like Texas, Florida, and Georgia—states that account for 35% of U.S. housing inventory. This isn't happening in small, isolated markets. It's occurring in some of the most important housing markets in the country.

At the end of February 2025, just 4 states were above pre-pandemic 2019 inventory levels: Colorado, Florida, Tennessee, and Texas. The fact that these states—traditionally high-growth markets—are leading the inventory surge speaks volumes about the broader market dynamics.

The Psychological Shift

37.4% of single-family homes on the market have taken a price cut, up 60 basis points for the week. When more than one-third of sellers are cutting prices, it signals a fundamental shift in market psychology. Sellers are recognizing that they can't command the prices they want, and buyers are becoming more selective.

Even without a formal recession, mortgage rates and high prices are reducing buyer demand, potentially accelerating if economic conditions worsen. This creates a self-reinforcing cycle where rising inventory leads to more price cuts, which leads to more cautious buyer behavior.

The Broader Economic Implications

The median sales price for existing homes increased 50% between 2019 and 2024, from $271,900 to $407,600. This level of price appreciation is simply unsustainable when wages haven't kept pace, and we're now seeing the inevitable adjustment.

U.S. home prices are currently less affordable relative to income and mortgage rates than at the height of the 2006 housing bubble. When affordability reaches such extreme levels, the market finds ways to correct itself—and rising inventory is one of those mechanisms.

What This Means for Traders and Investors

For those of us who read charts and understand market dynamics, the housing inventory explosion is sending a clear signal: the residential real estate market is under severe stress. This isn't a crash scenario—it's a prolonged period of adjustment where economic fundamentals are reasserting themselves.

Home prices are expected to rise by about 4% on average in 2025, but this masks significant regional variations. The markets seeing the biggest inventory builds are likely to experience the most price pressure.

The situation is not going to change until we get mortgage rates back down toward 5%, or even lower, and most forecasts don't see mortgage rates breaching 6% in 2025. This suggests we're in for an extended period of market adjustment.

The Bottom Line

The housing inventory explosion we're witnessing isn't just a statistical anomaly—it's a symptom of a housing market that has become fundamentally disconnected from the economic reality most Americans face. High mortgage rates, skyrocketing insurance costs, rising property taxes, and increasing maintenance expenses have created a perfect storm of unaffordability.

From an affordability perspective, 2025 will look a lot like 2024, with mortgage rates above 6%, home price growth easing but staying positive, and supply remaining below pre-pandemic levels nationally. However, the regional variations will be significant, and areas with the highest inventory builds will likely see the most dramatic adjustments.

For market participants, this represents both risk and opportunity. Those who understand the underlying dynamics and can navigate the changing conditions will find opportunities, while those who ignore the warning signs may find themselves caught in a market that's fundamentally different from what we've experienced over the past decade.

The housing market is sending us a clear message through these inventory numbers. The question is: are we listening?

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.