Labor Market Weakness: The Charts Are Screaming What the Headlines Won't Say

The mainstream financial media keeps talking about a "resilient" labor market, but here's the thing—when you dig beneath the surface and look at the actual data, a completely different story emerges. And as traders, we know that markets eventually catch up to reality, not the other way around.

I've been analyzing labor market data for over two decades, and what I'm seeing right now reminds me of those subtle shifts that occur just before major economic turning points. The kind of shifts that create massive opportunities for those who know how to read the signals correctly.

The Post-Stimulus Hangover Is Real

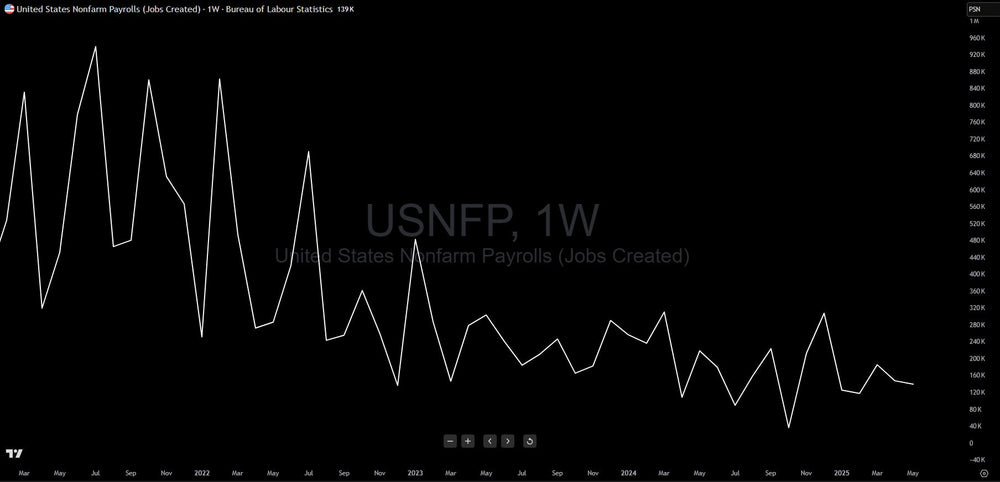

Let's start with the big picture, because context matters. The nonfarm payrolls chart tells a story that most analysts are glossing over. Back in 2022, we saw job creation numbers spiking above 1 million per month—numbers that frankly seemed unsustainable at the time. But here's what everyone seems to forget: those weren't normal market conditions.

We were dealing with the aftermath of unprecedented government and Federal Reserve liquidity injections post-COVID. Consumers had excess disposable income from stimulus payments, businesses were flush with PPP cash, and the Fed had interest rates at zero while simultaneously purchasing bonds at an extraordinary pace. Of course job creation was going to be artificially elevated.

Fast forwarding to today, and we're seeing the inevitable normalization. Current nonfarm payroll readings have declined steadily to the 100,000-200,000 range. That's not necessarily catastrophic, but it represents a clear downtrend from those stimulus-driven peaks. The question isn't whether this decline would happen—the question is how much further it goes.

The U6 Tells the Real Story

While everyone focuses on the headline unemployment rate sitting at 4.2%, I prefer looking at the U6 unemployment rate, which includes discouraged workers and those stuck in part-time jobs who want full-time work. This number currently sits at 7.8% as of April 2025.

Now, 7.8% might not sound alarming, but remember that this measures the total labor underutilization in our economy. U6 Unemployment Rate in the United States decreased to 7.80 percent in April from 7.90 percent in March of 2025. While we've seen a slight improvement from March, the broader trend shows labor underutilization remains stubbornly elevated compared to pre-pandemic levels.

This is where human psychology kicks in. When people can't find the hours they need or the jobs they want, they start making different spending decisions. They become more conservative with their money, which eventually shows up in corporate earnings and, ultimately, stock prices.

People Are Losing Hope: The Participation Rate Decline

Here's a data point that should make every investor sit up and take notice: Labor Force Participation Rate in the United States decreased to 62.40 percent in May from 62.60 percent in April of 2025.

When the labor force participation rate drops, it means people are literally giving up on finding work. They're not counted as unemployed because they've stopped looking entirely. This is textbook discouragement, and it's exactly what we see during the early stages of economic downturns.

"The unemployment rate would have risen to 4.3% if not for the decline in labor force participation," said Skanda Amarnath, executive director at Employ America. "The participation decline is disguising what was marginal deterioration in employment and the labor market in May."

Think about that for a moment. The unemployment rate is only staying stable because people are dropping out of the job search altogether. That's not resilience—that's capitulation.

Jobless Claims: The Canary in the Coal Mine

Initial jobless claims have been trending higher, and this is one of the most timely labor market indicators we have. Initial claims for state unemployment benefits rose 8,000 to a seasonally adjusted 247,000 for the week ended May 31, the highest level since last October.

But here's the number that really catches my attention: The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 26,000 to a seasonally adjusted 1.919 million during the week ending May 17, the highest since November 2021, the claims report showed.

Continuing claims at their highest level since November 2021 tells us that people aren't just losing jobs—they're having trouble finding new ones. This suggests that the job market has less fluidity than the headlines would have you believe.

JOLTS Data Confirms the Softening

The Job Openings and Labor Turnover Survey (JOLTS) provides another piece of our labor market puzzle. Layoffs increased 196,000, the largest rise since last July, to a still-low 1.786 million. This represents the biggest monthly increase in layoffs we've seen in nine months.

At the same time, we're seeing fewer people quit their jobs voluntarily. The Job Openings and Labor Turnover Survey, or JOLTS report, from the Labor Department on Tuesday also showed the number of people quitting their jobs for greener pastures declined by the most since last November.

When people stop quitting, it's usually because they don't have confidence in their ability to find something better. This is classic late-cycle behavior where workers become more risk-averse and employers become more selective.

Consumer Confidence: The Psychological Component

Here's where the human psychology element really comes into play. Consumer confidence in employment prospects has been deteriorating steadily. "Consumer confidence declined for a fifth consecutive month in April, falling to levels not seen since the onset of the COVID pandemic," said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.

More specifically, The view on the labor market also weakened, with those expecting more jobs to be available falling to 16.7%, while those expecting fewer jobs rose to 28.5%.

When consumers expect fewer jobs to be available, they modify their spending behavior accordingly. This creates a self-reinforcing cycle where reduced consumer spending leads to less demand for workers, which validates their initial pessimism.

New Graduates Face Their Toughest Market Since the Financial Crisis

Here's a statistic that should alarm anyone with kids heading to college: Recent college graduates' unemployment rate hit 5.8% as of March 2025, up from 4.6% a year earlier. According to the Federal Reserve Bank of New York, the labor market for recent college graduates deteriorated noticeably in the first quarter of 2025, with the underemployment rate rising sharply to 41.2%.

This represents the toughest job market for new college graduates since the depths of the COVID-19 pandemic. Entry-level hiring has dropped 23% compared to March 2020, while overall hiring has declined by only 18% over the same period. Think about that disparity—new graduates are being disproportionately shut out of the job market.

What makes this particularly concerning is that young college graduates have historically seen lower unemployment levels than the overall labor force. Since the 1980s, recent graduates have always had unemployment rates that were either around or below the national average. That pattern is now breaking down, which signals a fundamental shift in how the economy treats entry-level talent.

The psychological impact on this generation cannot be understated. After spending four years and often accumulating significant debt for their education, these young adults are finding themselves competing for fewer opportunities in an increasingly selective market.

The Functional Unemployment Crisis: 1 in 4 Americans Struggling

While the official unemployment rate sits at 4.2%, the reality is far more sobering when you dig deeper into what economists call "functional unemployment." According to research from the Ludwig Institute for Shared Economic Prosperity (LISEP), their True Rate of Unemployment (TRU) hit 24.3% in April 2025.

This means that nearly 1 in 4 Americans are either completely jobless or earning poverty-level wages below $20,000 annually—wages that are simply incompatible with supporting a family or achieving basic financial stability.

The research incorporates not just the traditionally unemployed, but also adults who are stuck in part-time positions when they need full-time work, or those earning wages so low they can't afford basic living expenses. As Gene Ludwig, who heads the nonprofit think tank explains: "In terms of what most people think of as employed, they think of someone who wants a full-time job [and] they can earn enough to put food on the table for themselves and their family—that it's more than a poverty wage."

The disparity between official statistics and lived reality is staggering. While politicians celebrate near-record-low unemployment rates, millions of Americans are drowning in financial despair, working multiple jobs just to make ends meet, or living in their vehicles because they can't afford rent despite having employment.

Women face a particularly harsh reality with a 28.6% functional unemployment rate compared to 20% for men. The situation is even more severe for minority communities, with Hispanic workers at 28% and Black workers at 27% functional unemployment rates.

The Tariff Uncertainty Factor

We can't discuss the current labor market without addressing the elephant in the room: trade policy uncertainty. Economists say President Donald Trump's flip-flopping on import duties has hampered businesses' ability to plan ahead.

This uncertainty is showing up in the employment data. Expected to be a drag on domestic demand, the duties already are prompting some companies to reduce staff. Manufacturing has been particularly hard hit, with some companies laying off workers in anticipation of higher input costs.

The psychological impact here extends beyond just the workers directly affected. When businesses can't plan effectively, they tend to err on the side of caution with hiring decisions.

Federal Government Employment: A Hidden Drag

One area that's not getting enough attention is federal government employment. And 27,000 federal workers have been laid off since January. While federal employment represents a relatively small portion of total employment, these job losses have ripple effects throughout the economy, particularly in the Washington D.C. area and regions with significant federal contractor presence.

What This Means for Markets

As traders and investors, we need to connect these dots to market implications. Labor market softening typically precedes broader economic weakness, which eventually shows up in corporate earnings and stock valuations.

The key question is timing. Economic cycles don't turn on a dime, but the data suggests we're in the early stages of a meaningful labor market deceleration. This doesn't necessarily mean recession is imminent, but it does mean we should start positioning more defensively.

Sectors that are typically sensitive to employment trends—consumer discretionary, housing, and financial services—may start to underperform as this data continues to deteriorate. Conversely, defensive sectors like utilities and consumer staples could outperform.

The Trading Psychology Element

Here's where my experience analyzing market cycles becomes crucial. Major economic turning points are rarely obvious in real time. They typically begin with subtle deterioration in employment data, just like what we're seeing now.

The danger for most investors is that they wait for confirmation from obvious indicators like rising unemployment rates or negative GDP growth. By then, the markets have often already made significant moves.

We're at a point where the employment data is clearly softening, but most market participants haven't fully grasped the implications. This creates opportunity for those willing to position ahead of the crowd.

Risk Management Considerations

None of this means we should panic or make dramatic portfolio changes overnight. But it does mean we should start preparing for a potentially different economic environment than what we've experienced over the past couple of years.

Consider reducing exposure to high-beta names that are particularly sensitive to economic cycles. Look for companies with strong balance sheets and pricing power that can weather a more challenging labor market.

This is also a time to be more selective with growth stocks. Companies that depend heavily on consumer discretionary spending may face headwinds as employment conditions continue to soften.

The Bottom Line

The labor market data is telling us a clear story: the post-pandemic boom is fading, and we're transitioning to a more challenging employment environment. The charts don't lie, even when the headlines try to sugar-coat the situation.

As always, successful trading requires staying ahead of the crowd and positioning for what's coming next, not what just happened. The employment data suggests we should start preparing for a more defensive market environment.

The key is watching how these trends develop over the coming months. If we continue to see deterioration in labor force participation, rising jobless claims, and weakening consumer confidence about employment prospects, it's going to eventually show up in corporate earnings and stock prices.

Remember, the market is forward-looking. By the time employment weakness becomes obvious to everyone, the trading opportunities will have already passed. Stay alert, stay positioned, and most importantly, stay ahead of the crowd.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.