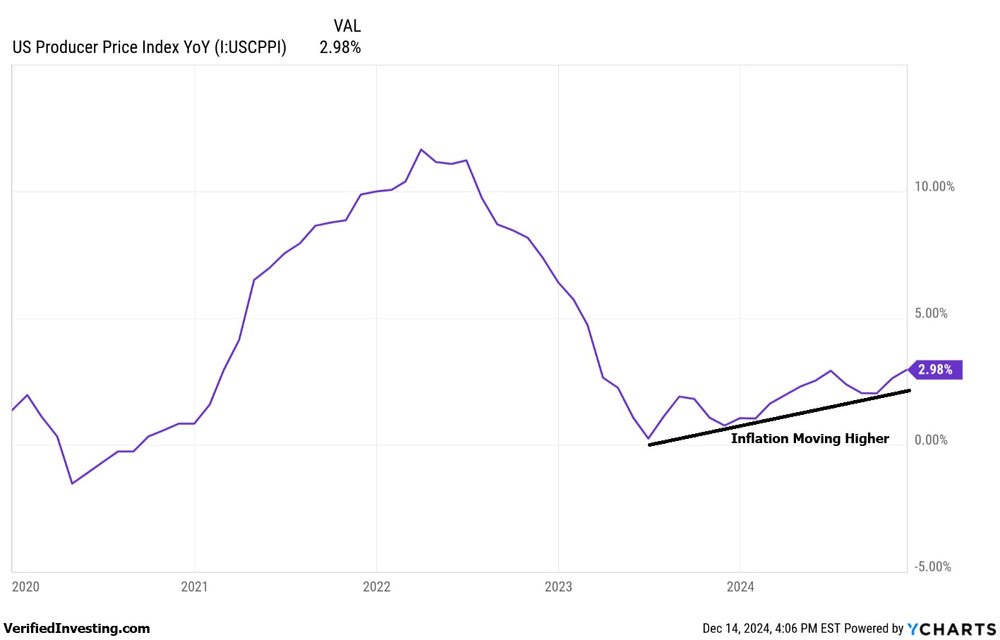

PPI Shows Inflation Is Moving Higher, Here Are The Keys

The Producer Price Index (PPI), a key measure of wholesale inflation, surged to 3% in November, exceeding expectations of 2.6%. This unexpected jump signals mounting inflationary pressure within the production pipeline.

Since producer-level inflation often precedes consumer price increases, this development raises concerns about the Federal Reserve's ability to combat inflation effectively. Despite plans for a 25 basis point rate cut, this "sticky" inflation may force the Fed to reconsider further cuts in 2025.

While the markets currently bask in the glow of all-time highs, investors should proceed with caution. 2025 presents a confluence of uncertainties: a new administration, the potential for inflationary tariffs, and a Federal Reserve potentially constrained in its ability to respond to economic weakness.

Let's now explore what makes up the Producer Price Index (PPI)...

The Producer Price Index (PPI) is a crucial economic indicator that tracks the average change in selling prices received by domestic producers for their goods and services over time. Essentially, it measures wholesale inflation, providing insights into price changes from the perspective of the seller, before those costs potentially trickle down to consumers.

Here's a breakdown of the PPI:

What makes up the PPI?

The PPI covers a wide range of goods and services across various industries, including:

- Goods: This encompasses everything from raw materials like lumber and steel to finished products like cars and electronics.

- Services: This includes a variety of services such as transportation, warehousing, and healthcare.

The PPI doesn't include imports, so it focuses specifically on domestic production.

How is the PPI calculated?

The Bureau of Labor Statistics (BLS) collects price data from thousands of establishments across the country. This data is then used to calculate price indexes for individual goods and services, as well as for broader industry categories.

The calculation involves several steps:

- Data Collection: The BLS surveys businesses, asking for the prices they receive for their products and services.

- Index Calculation: Price relatives are calculated by comparing current prices to a base period. These relatives are then weighted based on the importance of each good or service in the overall economy.

-

Aggregation: The weighted price relatives are aggregated to create various PPI indexes, including:

- Industry-level indexes: These track price changes within specific industries.

- Commodity-level indexes: These track price changes for specific goods and services.

- Final demand indexes: These track price changes for goods and services purchased for final consumption or investment.

The PPI is published monthly, providing a timely snapshot of inflationary trends at the wholesale level.

Why is the PPI important?

- Early Inflation Warning: Since the PPI measures price changes at the wholesale level, it can often provide an early warning of potential inflationary pressures that may eventually affect consumer prices.

- Business Planning: Businesses use the PPI to track the prices of their inputs, helping them make informed decisions about production and pricing strategies.

- Economic Policy: Policymakers, including the Federal Reserve, use the PPI to monitor inflation and make decisions about monetary policy.

By keeping an eye on the PPI, investors, businesses, and policymakers can gain valuable insights into the health of the economy and potential inflationary trends.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.