Retail Sales Jump Suggests Wealth Effect From The Stock Market

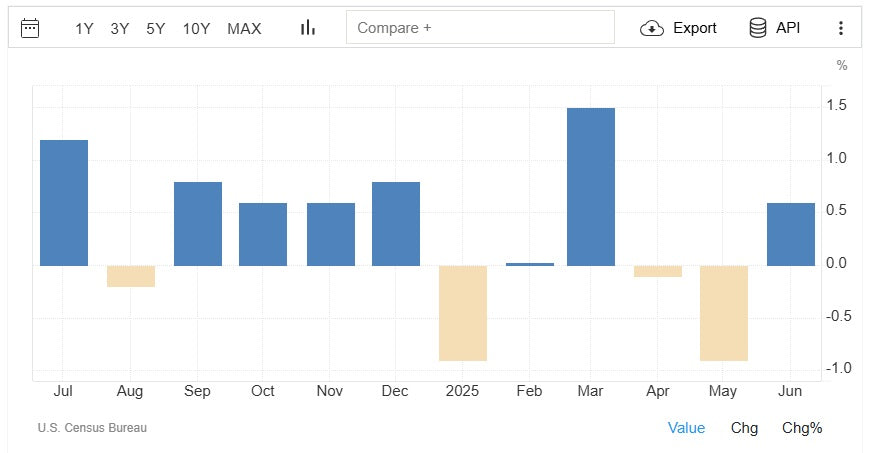

Retail Sales came in better-than-expected at +0.60% in the latest month. Economists had expected only a gain of 0.10%.

This data does not point to the consumer struggling, contrary to what economists expected.

The likely culprit of this surge in consumer spending is the stock market. Note how in May 2025, retail sales fell hard, reflecting the stock markets April 2025 (Liberation Day) collapse. However, as the stock market hits all-time highs in June and July 2025, consumers are loving their regained wealth and spending accordingly.

One other factor is likely that the minimal tariffs that were kept when President Trump pulled back on his mega tariffs from Liberation Day, have not caused a dramatic surge in prices. Consumers are happy that prices have not jumped significantly like many had fear. This paints a rosy picture and consumers are spending.

As long as inflation stays muted, the labor market holds steady and the stock market continues to make new all-time highs, consumers will likely keep spending. However, if one or all of these stumble, consumers will likely panic and stop spending.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.