Understanding The PCE Data Before It Hits This Week

Friday, July 26th, 2024 will see the PCE data released at 8:30am ET. The PCE data is the favored inflation gauge of the Federal Reserve and may determine when their first rate cut will come. Investors are currency pricing in a rate cut in September, 2024.

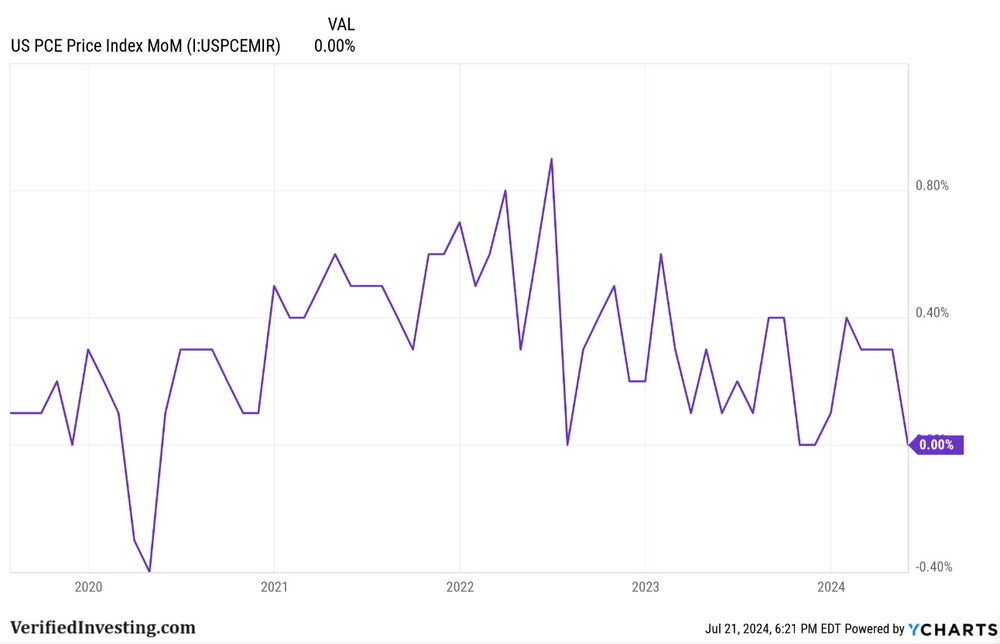

Expectations are for an increase of 0.1% month over month.

Last month PCE data came in at 0.00% month over month.

What Is The PCE?

The Personal Consumption Expenditures (PCE) price index is a measure of the prices paid by consumers for goods and services in the United States. It is produced by the Bureau of Economic Analysis (BEA) and is considered a key indicator of inflation.

Key aspects of the PCE inflation data:

- Broad Coverage: The PCE includes a wider range of goods and services than the Consumer Price Index (CPI), which is another common measure of inflation. This makes the PCE a more comprehensive reflection of consumer spending patterns.

- Consumer Behavior: The PCE accounts for changes in consumer behavior, such as substituting cheaper goods for more expensive ones when prices rise. This is known as the substitution effect, and it is not fully captured by the CPI.

- Federal Reserve's Preferred Measure: The Federal Reserve prefers the PCE as its primary inflation gauge because of its broad coverage and ability to capture changes in consumer behavior. The Fed's inflation target is based on the PCE.

Types of PCE Inflation Data:

- Headline PCE: This measures the overall change in prices of all goods and services purchased by consumers.

- Core PCE: This excludes volatile food and energy prices, which can fluctuate significantly from month to month. Core PCE is considered a better indicator of underlying inflation trends.

- Trimmed Mean PCE: This is an alternative measure of core inflation calculated by the Dallas Fed. It excludes the most extreme price changes on both ends of the spectrum, providing a more stable measure of underlying inflation.

- Median PCE: This is another alternative measure that focuses on the price change at the 50th percentile of the distribution. It is less affected by extreme price changes and can be useful for identifying the underlying trend in inflation.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.