Understanding The U.S. CPI Economic Data

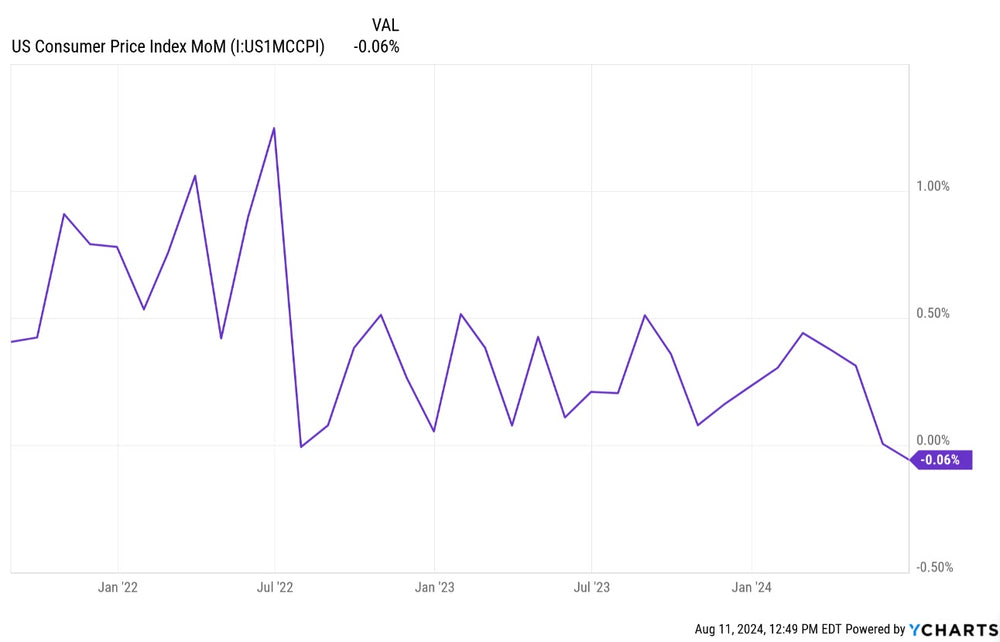

CPI data is due out on Wednesday August 14th. Expectations are for CPI (month over month) to come in at 0.2%. Last month it was -0.06. The CPI (year over year) is expected to come in at 3%. Last month it came at 3% as well.

The United States

Consumer Price Index (CPI) is a key economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of goods and services. It reflects the cost of living and is used to assess inflation, which is the rate at which prices are rising.

Current Situation:

-

As of June 2024, the CPI for All Urban Consumers (CPI-U) increased 3.0% over the last 12 months, indicating a moderate inflation rate.

Implications:

-

Inflation: The CPI is the primary gauge of inflation, which erodes the purchasing power of consumers. A moderate inflation rate is generally considered healthy for the economy, but high inflation can be detrimental.

- Monetary Policy: The Federal Reserve closely monitors the CPI to inform its decisions on interest rates. If inflation is rising too quickly, the Fed may raise interest rates to cool down the economy.

- Wages and Social Security: The CPI is used to adjust wages, Social Security benefits, and other payments to keep pace with inflation.

Important Considerations:

- Core CPI: The core CPI excludes volatile food and energy prices, providing a clearer picture of underlying inflationary trends.

-

Regional Variations: Inflation rates can vary across different regions of the United States.

- Expectations: Inflation expectations can influence actual inflation, as businesses and consumers may adjust their behavior based on their outlook for future prices.

Conclusion:

The current CPI number in the United States indicates a moderate level of inflation, which is generally considered positive for the economy. However, it is crucial to continue monitoring the CPI and other economic indicators to assess the trajectory of inflation and its potential impact on consumers and businesses.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.