Understanding The Upcoming Non Farm Payrolls Report

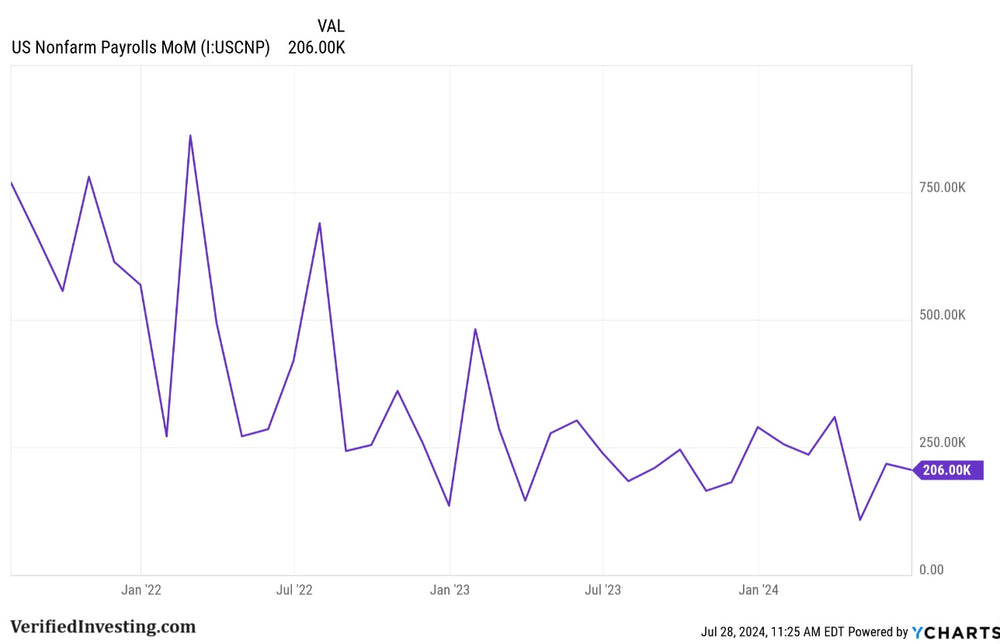

The Non Farm Payrolls report will be release on Friday August 2nd, 2024. Expectations are for a job gain of 177,000 vs last month gain of 206,000. Watch for revisions on the prior month as well as the current month.

The monthly nonfarm payrolls (NFP) report is a key economic indicator released by the U.S. Bureau of Labor Statistics (BLS) on the first Friday of each month.

It provides a snapshot of the labor market's health by detailing the number of jobs added or lost in the previous month, excluding workers in the agricultural sector, private households, and non-profit organizations.

Key components of the NFP report:

-

Headline number: Represents the total change in nonfarm payroll employment.

-

Unemployment rate: Indicates the percentage of the labor force that is unemployed and actively seeking employment.

-

Average hourly earnings: Measures the average hourly wage for all employees on private nonfarm payrolls.

- Labor force participation rate: Shows the percentage of the working-age population that is employed or actively looking for work.

Significance:

The NFP report is closely watched by investors, economists, and policymakers as it provides insights into the overall economic health and potential future direction of the economy. A strong NFP report can signal a growing economy and lead to increased investor confidence, while a weak report can indicate a slowing economy and potentially trigger market volatility.

Impact on financial markets:

The NFP report can have a significant impact on financial markets, particularly the stock market, bond market, and foreign exchange market. A better-than-expected report often leads to a strengthening of the U.S. dollar and a rise in Treasury yields, while a weaker-than-expected report can have the opposite effect.

How to interpret the NFP report:

To understand the NFP report, it is essential to consider the following:

- Compare to expectations: Assess the NFP report in relation to the consensus forecast by economists. A significant deviation from expectations can trigger market volatility.

- Look at trends: Analyze the NFP data over several months to identify underlying trends in the labor market.

- Consider other economic indicators: The NFP report should be viewed in conjunction with other economic data, such as GDP growth, inflation, and consumer spending, for a more comprehensive understanding of the economy.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.