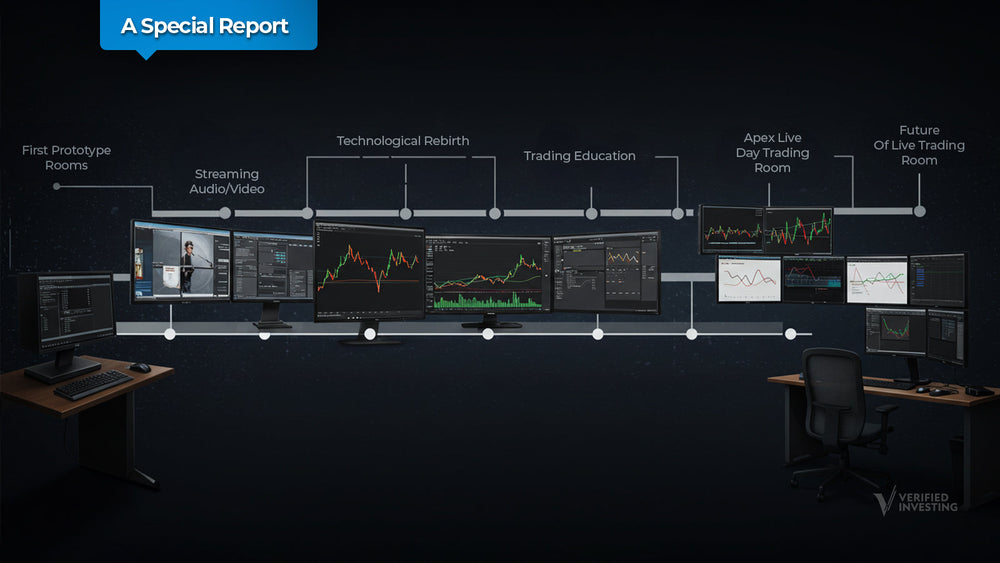

A Special Report: The Rise of Live Day Trading Rooms

Introduction: A Different Kind of Trading Floor

Sometime in the early 1990s, a handful of traders, brimming with adrenaline and ambition, found themselves experimenting with a cutting-edge idea: logging into a shared online space to swap real-time updates about price movements, chart setups, and entry signals. This nascent “virtual trading floor” wasn’t nearly as glamorous as the bustling Chicago or New York pits—there were no hand signals flying and no frenzied shouts echoing off marble walls. Instead, it was a modest digital chat interface, perhaps accompanied by a rudimentary audio stream if connection speeds allowed. Yet, within those basic lines of text, an entirely new culture began taking root. A culture of live day trading rooms that has since flourished into a global phenomenon.

Today, day trading rooms offer almost cinematic experiences: high-definition screen sharing, meticulously organized chat threads, real-time video commentary, market scanners, and an international community of traders plugged in around the clock. Some are run by charismatic figureheads, others by professional teams. Many are free, while some boast premium subscription models. Even major brokerages have integrated “virtual floors” or chat-based communities into their platforms to capture this new wave of participatory trading.

This report unravels the evolution of these trading rooms—from humble experiments in the early days of internet adoption, through the dot-com bubble, to the advanced streaming ecosystems we know today. Along the way, we’ll explore how different styles and philosophies emerged, shaping the day trading landscape. Finally, we’ll offer a glimpse of Verified Investing’s own entry into this space via the Apex Live Day Trading Room, discussing its approach and context in a field teeming with hype and potential pitfalls. Our aim is to paint a vivid, novelistic portrait of a financial subculture that—despite its digital nature—remains deeply personal, dynamic, and, for many, profoundly transformative.

1. The Genesis: An Accidental Invention?

The idea of trading alongside others has existed since the dawn of organized markets. Early stock exchanges were essentially physical day trading rooms, where speculators and brokers jostled elbow-to-elbow. But the concept of a virtual day trading room—an online environment where individuals share real-time trades and commentary—only became viable when home internet connections matured enough to handle the demands of synchronous communication.

1.1 The First Prototype “Rooms”

- Late 1980s/Early 1990s Bulletin Boards: Long before web-based chat, some pioneering traders gathered on dial-up bulletin board systems (BBS). They posted daily picks and swapped War Stories of big wins or losses. While not “live” in the sense we understand today, these BBS communities set the stage by proving that distance was no barrier to shared market insights.

- Early IRC Channels: With the rise of Internet Relay Chat (IRC) in the early ’90s, a few adventurous souls launched channels dedicated to stock or futures talk. Users typed out quick remarks about price action or upcoming economic releases. Latency was high, and many participants lurked more than they contributed. But for the first time, real-time text commentary about the market was just a keystroke away for anyone with an internet connection.

- Basic Teleconferences: Some “rooms” started offline, ironically enough, via teleconference calls. A small group of day traders would dial into a shared phone line, narrating what they saw on their feeds. Not exactly a slick production, but effective for small pockets of participants starved for a sense of camaraderie in an otherwise solitary profession.

1.2 A Bold Leap of Faith

These early-day structures often faced ridicule from established floor traders: “Why would you trust someone on a chat line?” or “Isn’t live collaboration a crutch for amateurs?” But the seeds were sown. Even if connectivity was spotty and the user interfaces clunky, the desire for instant communication with fellow traders was crystal clear. By the mid-1990s, the concept of live day trading rooms was itching to break free from the fringes—just waiting for better technology to unlock its full potential.

2. The Dot-Com Boom: A Fertile Ground for Collaboration

The second half of the 1990s ushered in a period of euphoria. The dot-com boom wasn’t just about Silicon Valley startups rocketing into the stratosphere; it also redefined how everyday people engaged with the market. Fueled by discount brokerages and newly accessible data feeds, day trading soared in popularity.

2.1 Enter the Day Trading Mavens

- Proliferation of Chat-Based Rooms: Suddenly, hosting a chat-based trading room became feasible for small businesses or even entrepreneurial traders with some tech savvy. They’d share price quotes (often delayed by 15 minutes, unless you paid for real-time data), discuss chart patterns, and collectively watch the dizzying rise of internet stocks like Yahoo, eBay, and Amazon.

- Subscription Models Emerge: Realizing the potential for monetization, certain “day trading gurus” launched membership-based chat rooms. For a monthly fee, you could watch an experienced trader’s screen (or at least read their commentary), gleaning insights on potential breakouts or short squeezes. These early subscription models—though rudimentary—foreshadowed the robust day trading ecosystems we see now.

2.2 Technological Enablers

- Faster Internet: Dial-up was giving way to DSL and cable modems in many urban areas, drastically improving speed. This meant chat rooms could run with near real-time quotes and minimal lag for text communication.

- Affordable Trading Platforms: Early direct-access software from brokers like Datek or E*TRADE provided the vantage to see streaming Level II quotes. Some platforms integrated chat modules or partnered with newly formed day trading communities.

- Streaming Audio/Video: While still in its infancy, the ability to do a live audio broadcast gave certain room moderators the power to speak rather than type trade ideas. Even if the quality was sketchy, it added a layer of immersion that text alone couldn’t match.

The synergy of these elements ignited a new era: day trading was no longer the domain of hush-hush operations in downtown offices. It had gone online, communal, and—in some circles—became an almost lifestyle movement, epitomized by the adrenaline-fueled successes (and heartbreaks) of the dot-com era.

3. After the Crash: Adapting and Evolving

Then came the year 2000, and the dot-com bubble burst like a shaken soda can. Many day traders saw their once-explosive gains reverse overnight. Countless online communities vanished as participants retreated or left the markets in despair.

Yet the “live day trading room” concept proved more resilient than the speculative froth. While membership in some rooms plummeted, others adapted and found ways to deliver continued value—emphasizing risk management, technical analysis, and emotional discipline.

3.1 The Survivors and Their Pivot

- Shift Toward Education: The day trading rooms that endured realized they needed to offer more than hot tips on “the next Amazon.” They started incorporating structured lessons on charting techniques, position sizing, and mental fortitude. The chat room format evolved into a classroom-like environment, bridging the gap between real trades and educational modules.

- Greater Transparency: People grew wary of unverified claims, so many room operators introduced “trade verification” methods, or at least posted real-time call-outs. In some cases, members demanded proof of broker statements—though not all providers obliged.

- Diversification of Instruments: Instead of laser-focusing on equities, rooms branched out into forex, futures, and options. This broadened their appeal to those seeking fresh corners of the market.

3.2 Technological Rebirth

- Screen Sharing & Platforms: As screen-sharing apps like GoToMeeting and later Zoom became mainstream, day trading rooms upgraded. Moderators no longer merely typed signals in chat—they hosted live video streams or “desk cams,” letting participants peek at real-time charts and indicators.

- Automated Alerts & Bots: Some rooms integrated automated signal bots that would parse real-time data for breakouts or unusual volume. Chat participants could follow a text or audio alert, jump to the chart, and discuss potential trades.

- Broker Partnerships: A few day trading rooms partnered with brokerages, linking direct order execution to the live trade calls. This synergy streamlined the user experience—though it also raised questions about potential conflicts of interest.

By the mid-2000s, live day trading rooms had morphed into a more sophisticated beast, harnessing sharper tools and forging deeper communal bonds than their 1990s predecessors. It was no longer just about capturing a piece of the dot-com gold rush. Now it was about staying power, consistent methodology, and leveraging technology for an edge.

4. Modern-Day Trading Rooms: A Landscape of Contrasts

Fast forward to our current decade, and day trading rooms span a striking range of philosophies, styles, and business models. Some are polished corporate ventures offering institutional-grade tools, while others remain small, tight-knit groups with a personal vibe.

4.1 The Full Spectrum

-

Mentor-Led Communities

- Typically revolve around a seasoned trader (or team) who shares screens, commentary, and real-time trades. Members can ask questions, mimic the mentor’s trades, or simply absorb the thought process.

- Often subscription-based, with structured daily schedules: a morning briefing, midday scanning, afternoon wrap-up.

-

Free ‘Open Door’ Rooms

- Some are ad-supported or run by brokers who want to attract new clients. They can be chaotic, lacking a central voice. The advantage: free-flowing discussion, immediate crowd-sourced sentiment. The drawback: reliability and signal-to-noise ratio might suffer.

-

Algorithmic/Signal Rooms

- Instead of following a human guru, members watch automated algorithms call out trades. Proponents laud the lack of emotional bias. Critics argue that purely mechanical systems can fail if market conditions shift abruptly.

-

Hybrid Education & Live Trading Platforms

- Merging formal educational courses with daily live sessions, these cater to newcomers who want both conceptual learning (e.g., chart patterns, risk management) and the adrenaline of a real trading environment.

-

Private Invite-Only Rooms

- Elite circles or prop firms that share high-level research or specialized strategies. Members might be employees or advanced traders selected for synergy. The secrecy fosters close collaboration—but also excludes novices.

4.2 Cultural & Psychosocial Dynamics

- Community Vibe: Many participants thrive on the camaraderie. Trading can be isolating, and a chat room fosters a shared sense of mission. Encouragement, peer feedback, and moral support reduce the emotional toll of day trading.

- Accountability: Publicly posting trades or responding in real time to a mentor’s calls can enforce discipline. The knowledge that others are tracking your progress is a powerful deterrent to impulsive moves.

- Common Pitfalls: Overreliance on any single figure’s calls can hamper independent judgment. Some novices chase every trade an “expert” mentions, ignoring personal risk tolerance. When losses occur, blame and negativity can spiral within the community.

5. The Apex Live Day Trading Room: Verified Investing’s Chapter in This Story

Among the many established players in this space, Verified Investing hosts its own live day trading environment known as the Apex Live Day Trading Room. While avoiding any overt sales pitch, it’s worth noting how this room sits within the historical tapestry we’ve just sketched.

5.1 Distinguishing Elements

- Longevity & Track Record: Verified Investing’s day trading offerings date back to a period when “live streaming” was still a novel concept. Over time, they’ve evolved their format, capitalizing on improved streaming tech to deliver crisp video charts and near real-time commentary.

- Objective, Fact-Based Approach: Consistent with Verified Investing’s broader philosophy, the Apex room emphasizes data-driven strategies, technical indicators, and consistent risk management. The brand’s stance of “no hype, no nonsense” resonates with traders who’ve grown wary of inflated claims elsewhere.

- Educational Overlay: Rather than purely calling out trades, the moderators dissect the reasoning—why a certain support level matters, how to spot shifting momentum, or when to scale out. This merges the appeal of a collaborative environment with the structure of a mini-course in real-world conditions.

- Community Interaction: Many participants highlight the balanced culture—newcomers are encouraged to ask questions, while experienced members offer additional perspectives. This synergy fosters a sense of organic, evolving learning rather than a strict guru-disciple dynamic.

5.2 Real-World Considerations

- Transparency: The day trading room aims to be transparent about trade calls. While no one can guarantee profits, each setup is explained in plain language.

- Consistency Over Flash: Instead of marketing single big wins, Apex’s ethos is about cumulative, carefully executed trades. In a domain rife with sensational success stories, that emphasis on consistency can be refreshing.

- The Broader Context: Apex is just one example in a sprawling ecosystem. For those exploring day trading rooms, the lesson is to apply the same rigorous judgment: check track records, engage with the community, and confirm that the methodology aligns with your temperament and goals.

6. Facts, Figures, and The Question of Longevity

While live day trading rooms have soared in popularity, it’s vital to ask: Do they truly help traders become profitable? There’s no one-size-fits-all answer. However, certain statistics and studies shed light:

- A 2014 Study: In the Journal of Finance, researchers found that a community-based approach to intraday trading could reduce common behavioral errors (like revenge trading after a loss), as peer feedback acted as a moderating force.

- Industry Surveys: Various broker-led surveys suggest that 30–45% of novice day traders credit their “improved discipline” to participation in a live trading environment.

- Attrition Rates: Despite the communal benefits, day trading remains challenging. Roughly 75–80% of aspiring day traders still drop out within the first two years. Live rooms can reduce that churn but won’t eliminate it entirely; success still demands personal discipline, risk control, and mental resilience.

Despite these complexities, the narrative remains compelling: for those who can navigate the hype, maintain a critical eye, and consistently apply best practices, a trading room can amplify learning and provide a sense of accountability that is often lacking in solitary, home-based setups.

7. Why the Day Trading Room Concept Continues to Thrive

Reflecting on the entire journey, from early BBS boards to advanced streaming communities, it’s remarkable how persistent the concept has been. Technological leaps, regulatory shifts, and market crashes haven’t stifled it—instead, they’ve spurred adaptation and refinement.

Some core reasons for this enduring appeal:

- Human Connection: Day trading can be lonely, especially for self-directed individuals who have no colleagues to bounce ideas off. A live room fosters instant feedback and camaraderie.

- Real-Time Learning: Watching markets in real time with a group is a far richer experience than reading post-market recaps. You see, think, and act in the moment, which is where true day trading skill is forged.

- Shared Emotion & Support: Gains can be celebrated collectively; losses can be dissected for lessons, reducing the emotional sting.

- Adaptive Tools & Content: Rooms have grown to include advanced charting overlays, one-click trade copy features, or even AI-driven insights. The synergy of technology with human commentary keeps participants engaged and open to new developments.

Far from being a fad, day trading rooms appear poised to remain a staple in the trading landscape, evolving as hardware, software, and user demands evolve in tandem.

Conclusion: Charting Your Own Path

The saga of live day trading rooms parallels the broader story of online trading itself—beginning with hesitant dial-up gatherings, blossoming during tech booms, weathering market crashes, and maturing into an established sub-industry that merges technology with community.

For traders evaluating a day trading room—be it Verified Investing’s Apex or any other offering—the takeaway is clarity of purpose. Are you seeking a crash course in real-time strategy? Hoping for a social environment that keeps you accountable? Looking to replicate the trades of a veteran mentor? Each day trading room caters to a unique blend of these aspirations, so matching the culture and methodology to your personal style is critical.

Meanwhile, the cautionary notes persist: no chat room can magically eliminate the learning curve or the inherent risks of day trading. At its best, a trading room provides structure, immediate feedback, and a platform to refine skills. At its worst, it might descend into noise, hype, or dependence on someone else’s trade calls.

Ultimately, it’s the synergy between a robust environment and a disciplined participant that unlocks potential in day trading rooms. As with every revolution we’ve traced—from early online bulletin boards to factor investing or HFT—the rebellious idea that a real-time communal exchange of insights could drive better trading decisions is now part of our daily routine. The only question remaining: will you step onto this virtual floor, headphones ready, charts in front of you, adrenaline rising as the opening bell rings?

Because in the end, day trading might be an individual pursuit, but it doesn’t have to be a solitary one.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.