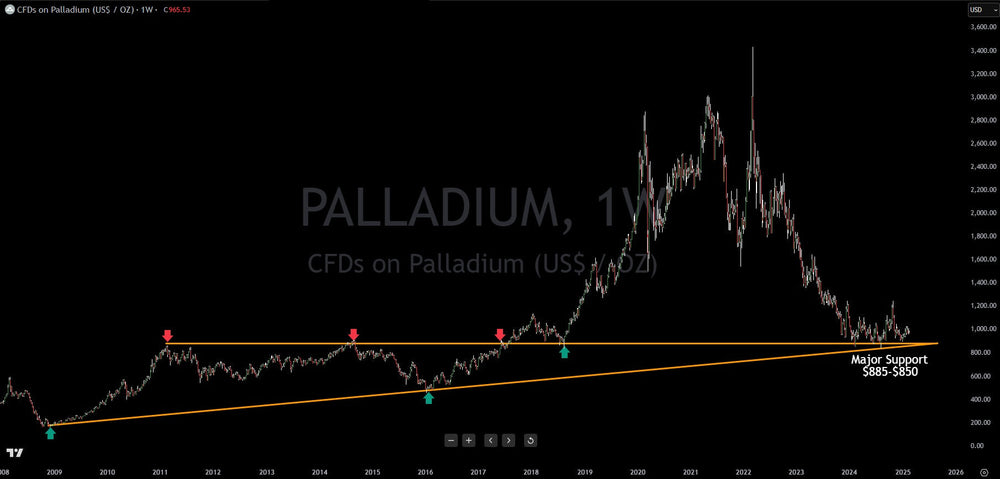

Palladium Holds Major Support: Upside Until Proven Otherwise

The commodity palladium currently presents an intriguing trading opportunity, driven by a confluence of technical and fundamental factors. At its present levels, palladium is navigating a crucial support zone, situated between $885 and $850. This zone is not arbitrary; it's defined by the convergence of two significant, long-term trendlines, bolstering its importance.

Technical Foundations:

-

Long-Term Trendline 1 (2008-Present):

- This trendline originates from the 2008 financial crisis lows and intersects with the December 2015 low.

- Projecting this line forward, it has recently been retested by palladium's price, validating its ongoing relevance as a support level.

-

Long-Term Trendline 2 (2011-Present):

- This trendline connects the peaks of 2011, 2014, and 2017, representing a key resistance level that was subsequently breached.

- The recent pullback has brought palladium's price back to this trendline, now acting as support at approximately $885, a classic example of former resistance becoming support.

- Significance of the Support Zone: The overlap of these two long-term trend lines creates a very strong support zone. A break below this zone would be very bearish, but while it holds, it is very bullish.

Fundamental Underpinnings:

-

Scarcity and Relative Value:

- Palladium's inherent scarcity, being approximately 30 times rarer than gold, lends it intrinsic value.

- However, despite this rarity, palladium is currently trading at levels comparable to those seen in 2017 and 2018.

- This is happening while gold has approximately doubled in price since that same time frame.

-

Palladium-Gold Ratio:

- The palladium-to-gold ratio, currently around 0.3, is historically low. This indicates that palladium is significantly undervalued relative to gold.

- This ratio implies a large potential upside for palladium, should it revert to its historical average.

-

Industrial Demand:

- Palladium's primary use is in catalytic converters for gasoline-powered vehicles, where it helps reduce harmful emissions. While the automotive industry is shifting towards electric vehicles, internal combustion engines, and therefore palladium, will remain relevant for many years to come, especially in developing markets.

- Supply disruptions, often due to mining issues in major producing countries like Russia and South Africa, can also significantly impact palladium prices.

- Supply of palladium can be volatile, and demand can be stable. This creates an environment where price can change rapidly.

Investment Thesis:

The combination of robust technical support and compelling fundamental undervaluation creates a strong case for a bullish outlook on palladium. As long as the price maintains its position above the $885-$850 support zone, it is poised for substantial appreciation. A return to the historical average palladium-gold ratio could potentially result in a doubling of palladium's price.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.