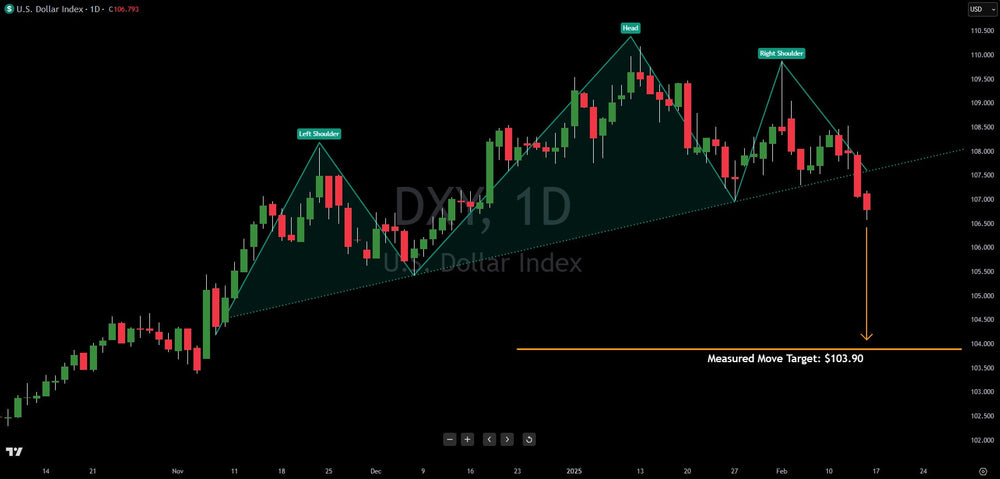

U.S. Dollar (DXU) Head & Shoulder Triggers, Here Is The Target

The US Dollar (DXY) has broken below the neckline of a head and shoulders pattern, a bearish technical formation, signaling a potential significant decline. This breakdown, occurring after hotter-than-anticipated inflation figures and amidst growing concerns about a slowing economy, projects a downside target of $103.90, calculated from the neckline break at $107.50. A move of this magnitude in the world's reserve currency carries substantial implications for various asset classes.

A weaker dollar generally acts as a tailwind for gold, and while gold has already rallied to new all-time highs recently, this added pressure could fuel further upside. Even with potential short-term pullbacks, a move above $3,000 within the year appears increasingly plausible. The inverse relationship between the dollar and gold often sees them move in opposite directions, so a weaker dollar typically supports higher gold prices.

Initially, a weakening dollar can be beneficial for US stocks, particularly for multinational corporations. These companies, which derive a significant portion of their revenue from overseas operations, benefit from favorable currency translation when repatriating profits back to the US. The strong dollar in recent quarters has acted as a drag on their earnings, a situation that a weaker dollar would alleviate.

However, the positive impact on stocks can be short-lived. If the dollar's decline persists and is driven by a rapidly deteriorating US economy, the narrative shifts from a currency tailwind to a broader economic headwind. In this scenario, a weakening dollar becomes a symptom of underlying economic problems, which would ultimately be bearish for stocks. Investors would likely become more concerned about declining corporate profits and overall economic weakness rather than focusing on the currency translation benefits.

Therefore, while the near-term target of $103.90 for the DXY is a key level to watch, its implications depend heavily on the underlying reasons for the dollar's weakness. If the decline is orderly and reflects a moderate economic slowdown, the initial bullish impact on gold and stocks could persist. However, a sharp and sustained decline driven by a rapidly weakening economy would likely trigger a risk-off sentiment, impacting all asset classes negatively, even gold, despite its initial bullish reaction. The speed and magnitude of the dollar's move, alongside other economic indicators, will be crucial in determining the ultimate market impact. This target of $103.90 could be reached within the coming months, making close monitoring essential.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.