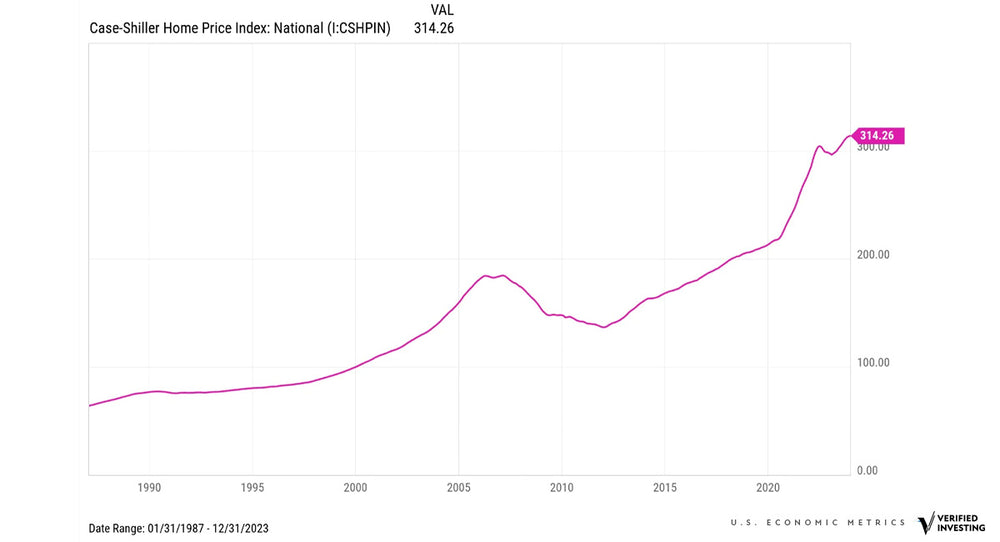

Case-Shiller Home Price Analysis

The Case-Shiller Home Price Index is trading at all-time highs. This is a major thorn in the side of the Federal Reserve who said one of the things they wanted to achieve was more affordable homes prices for Americans. They failed miserably at this.

While home prices did pull back slightly in 2022, they have roared back to all-time highs. This is partly due to low inventories of new homes, coupled with many homeowners having locked in rates at 3% or lower. These homeowners do not want to sell their current home to buy a new home as they would lose their 3% rate when they flip over to a new mortgage. Classic example of unintended consequences of covid low interest rates, the Federal Reserve's own doing.

With the Case-Shiller Home Price Index at all-time highs and inflation inching higher, Americans are back to struggling to buy a home or paying high rents. Now that the Federal Reserve is talking about lowering rates again, which will likely cause another uptick in home prices. The only chance of a drop in home prices is if the economy weakens substantially.

The Case-Shiller Home Price Index is reported on the last Tuesday of every month.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.