CPI And PPI Data Analysis

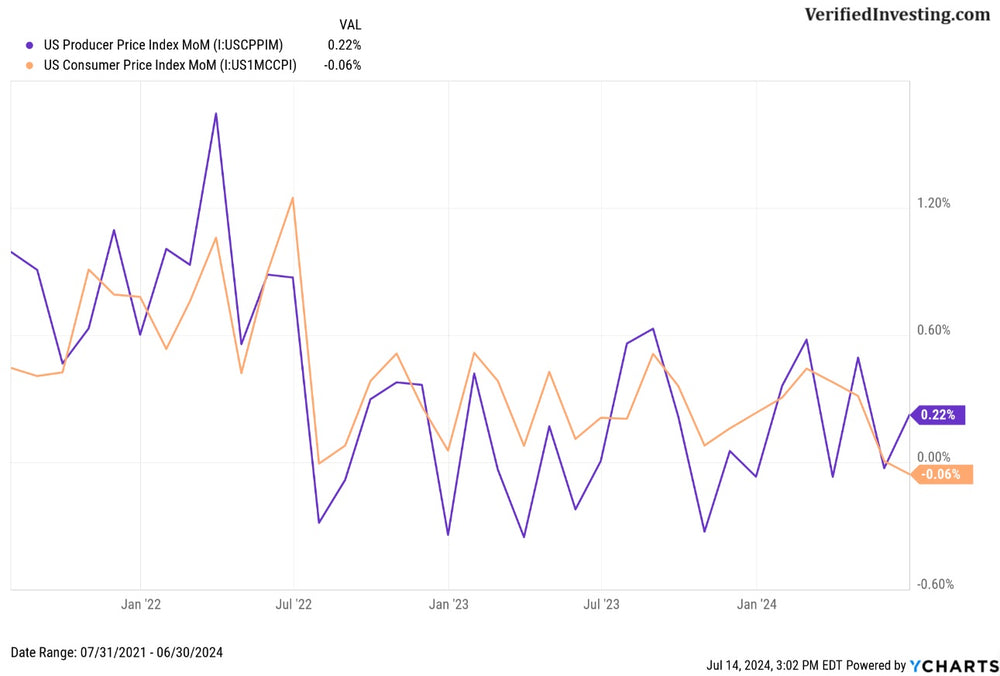

Much was made about the month over month CPI going negative recently. Many talked about deflation and inflation coming back to the 2% level the Federal Reserve wants. However, just after the CPI, the PPI was released and it showed an uptick in inflation.

More importantly, the data clearly shows that over the last year CPI and PPI have been chopping sideways, not declining as investors hoped. This signals that the market may be too optimistic with the recent data.

It appears the Federal Reserve will cut rates in September based on what Jerome Powell said in his latest testimony in front of congress. This now appears more and more to be the Federal Reserve looking for a clear reason to justify a rate cut as they see the economic data deteriorating.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.