Fed Funds Rate: Interest Rate Analysis

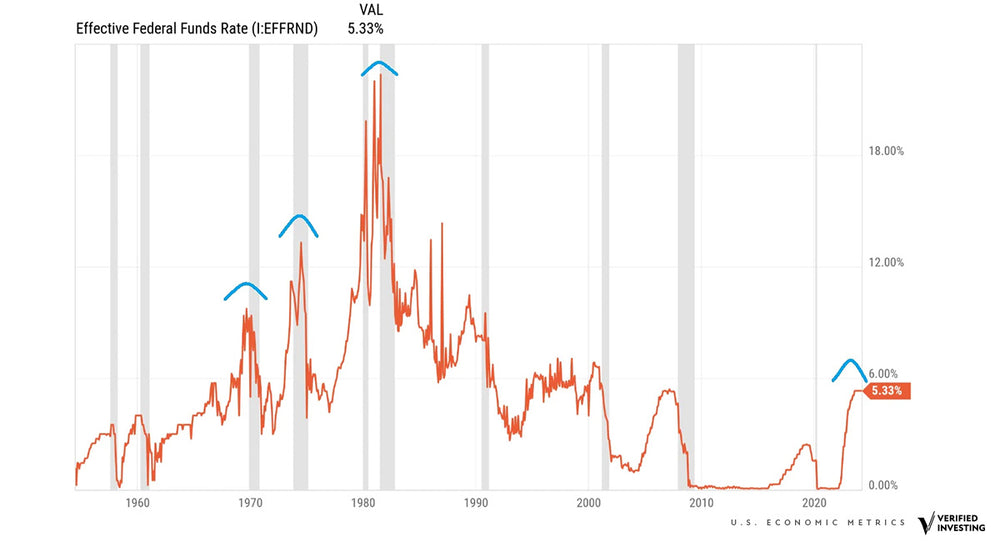

The Federal Reserve has raised interest rates aggressively over the last couple years to combat high inflation. The current effective fed funds rate sits at 5.33%.

While the fed funds rate sits at 5.33%, the 10 year yield (interest rate) has fallen back between 4.10% and 4.30%. The reason for this decline in the 10 year yield is due to expectations of rate cuts coming by the Federal Reserve. In other words, the 10 year yield is factoring in expectations for the fed funds rate.

As of now the Fed Watch Tool shows investors expecting 3 rate cuts in 2024 and more in 2025. The first rate cut is expected at the Federal Reserve meeting on June 12th, 2024.

The biggest concern for hawks is that the pop in inflation is repeating the scenario experienced in the 1970s. This is when the Federal Reserve lowered rates too quickly, inflation spiked again and the Federal Reserve has to hike interest rates higher. This happened a total of three times.

With inflation up-ticking already and the Federal Reserve seemingly intent on lowering rates, this looks like a possible scenario. Note the chart from the 1970s and the current fed funds rate.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.