10 Year Yield Target: Based On Trend Line Analysis

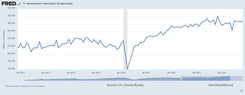

The 10 year yield is trading at $3.655%, much lower than the 5.02% highs last seen in October 2023. However, the Federal Reserve has yet to lower rates, which still stand at 5.25%-5.50%. Most investors are confused by this. Let’s break it down.

The 10 year yield is forward looking. In general, 12 months out. In other words, investors that are trading the 10 year bond are calculating where they expect interest rates to be in one year from now. That is why the 10 year yield is trading at 3.655% vs where the Fed Funds Rate is currently at. In other words, investors expect the Federal Reserve to cut rates to 3.655% within 12 months. The 10 year yield will adjust as 12 month expectations change in the coming days, weeks and months.

Based on trend line analysis, the 10 year yield continues to look like it has broken down and will head lower. There is a confluence of two trend lines that converge at 3.20%. These trend lines are long-term lines, going back to 2018 and 2020 (covid lows).

This generally implies a weakening economy and likely no soft/no landing scenario.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.