Global Debt To GDP

Published At: Dec 07, 2024 by

Gareth Soloway

Global debt-to-GDP is a key indicator of the health of the global economy. It represents the total debt (public and private) of all countries in the world relative to their combined gross domestic product (GDP). Here's a breakdown of what you should know:

What it tells us:

- Debt burden: A high debt-to-GDP ratio indicates that countries have a large amount of debt compared to their economic output. This can make it difficult to repay debt and can limit economic growth.

- Financial risk: High levels of debt can increase the risk of financial crises, as countries may struggle to meet their debt obligations.

- Economic vulnerability: High debt-to-GDP ratios can make countries more vulnerable to economic shocks, such as recessions or rising interest rates.

Current state of global debt-to-GDP:

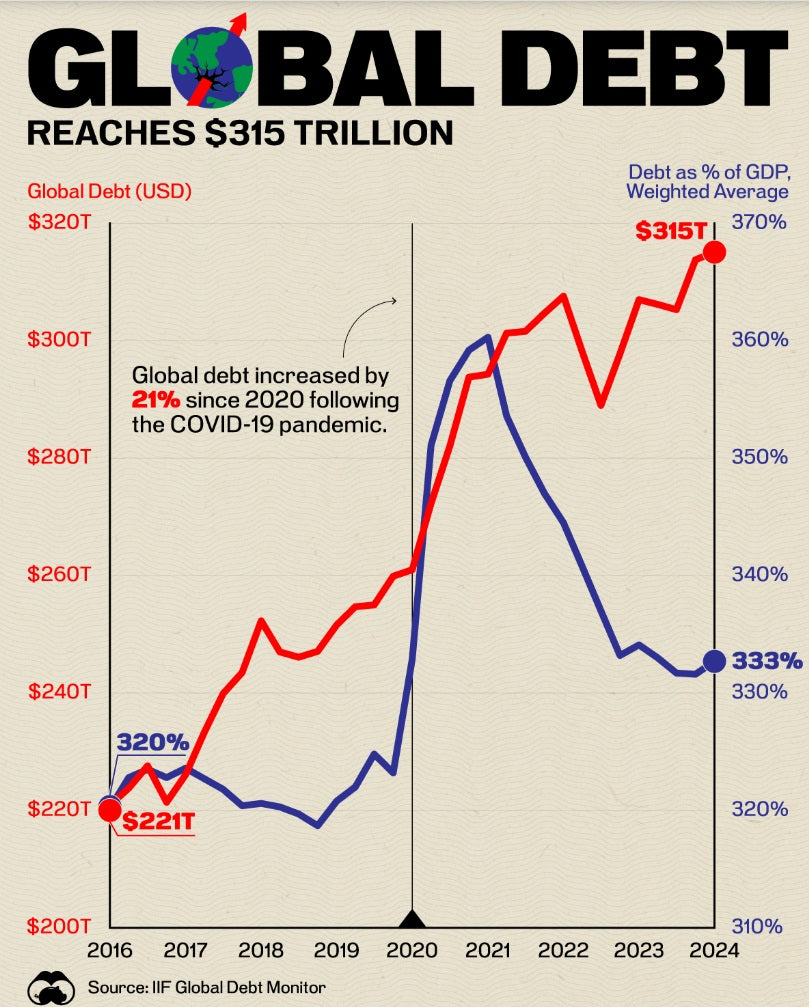

- Record levels: Global debt-to-GDP has been on an upward trend for decades, reaching record highs in recent years. This has been driven by factors such as the global financial crisis, the COVID-19 pandemic, and low interest rates.

- Slight decline: While it remains elevated, global debt-to-GDP declined slightly in 2021 and 2022 due to economic recovery and higher inflation. However, it is expected to rise again in the coming years.

- Concerns: The high level of global debt raises concerns about the sustainability of debt levels and the potential for future financial instability.

Key factors influencing global debt-to-GDP:

- Government borrowing: Government debt has increased significantly in many countries due to factors such as fiscal stimulus measures and the need to finance public services.

- Corporate debt: Companies have also taken on more debt, often to finance investments or share buybacks.

- Household debt: In some countries, household debt has also risen, driven by factors such as rising house prices and increased consumer spending.

- Interest rates: Low interest rates have made it cheaper for governments, companies, and households to borrow, contributing to the increase in debt.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.