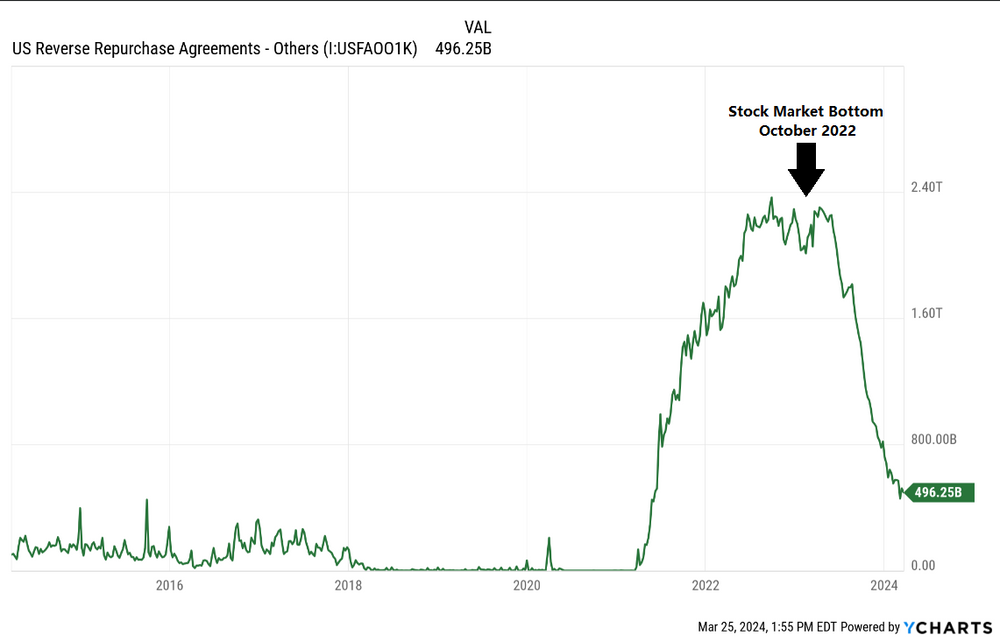

How Reverse Repo Signaled The 2022 Stock Market Low

Understanding Reverse Repo helps investors understand why the stock market bottomed in October 2022. It all comes down to money in the system.

Reverse Repo is a service the Federal Reserve offers the banks. Banks can park money at the Federal Reserve accumulating interest. When reverse repo goes up, banks are parking billions if not trillions at the Federal Reserve. When reverse repo goes down, the Federal Reserve is sending billions if not trillions (with interest) back to the banks.

This explains why the stock market bottomed in October 2022 when reverse repo topped. In other words, starting in October of 2022, the Federal Reserve began sending billions back to the banks which then put it into the system via lending or investing.

With reverse repo almost back to its normalized levels, it may spell trouble for the stock market. As these billions being sent to the banks from the Federal Reserve, it may mean money flow into risk assets like the stock market will also dry up.

Just something to watch in the coming weeks/months.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.