Technical Analysis: USD/JPY Showing Downside Risk

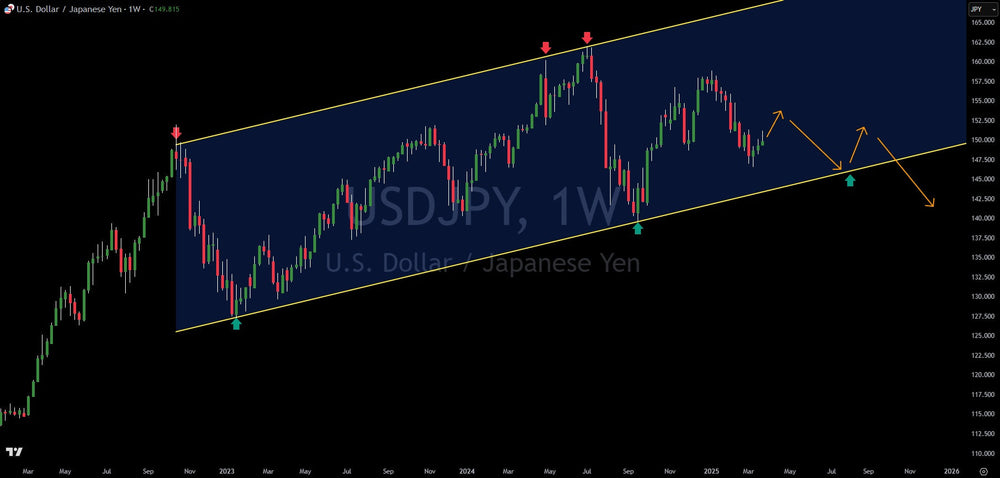

The U.S. Dollar/Japanese Yen (USD/JPY) has been exhibiting a persistent uptrend, contained within a well-defined ascending parallel channel. This technical pattern is characterized by two parallel trend lines that act as dynamic support and resistance levels, guiding the price action. While such channels can indicate a strong underlying trend, they often face a higher probability of breaking to the downside after the price has tested the channel boundaries multiple times.

Currently, the USD/JPY has touched lower trend lines of this channel twice. According to technical analysis principles, the third interaction with either boundary, particularly the lower one in this case, is significant. The anticipated scenario is a further decline to tag the lower parallel trend line for a third time. Following this expected touch, a short-term bounce might occur. However, the prevailing probability, based on the historical behavior of parallel channels, favors a subsequent breakdown below the lower trend line.

A breakdown from this ascending channel would imply a strengthening of the Japanese Yen against the U.S. Dollar. This potential Yen appreciation could be driven by several underlying factors, including concerns about the U.S. economic outlook. A weakening U.S. economy might prompt the Federal Reserve to consider lowering interest rates and potentially implementing further stimulus measures. Such actions could dilute the value of the Dollar, making it relatively less attractive compared to the Yen.

The current economic landscape in the U.S. lends credence to this scenario. The implications of existing tariffs, coupled with signs of slowing consumer spending and persistent inflationary pressures, are raising concerns about an impending economic slowdown. Logically, these factors could indeed contribute to a weaker Dollar. Tariffs can stifle economic growth by increasing costs for businesses and consumers. Slowing consumer spending, a key driver of the U.S. economy, indicates reduced demand. Persistent inflation, despite efforts to control it, can erode purchasing power and further dampen consumer sentiment.

It's important to note that while technical patterns provide valuable insights, they should be considered alongside fundamental economic analysis. The confluence of the technical signal (potential channel breakdown) and the concerning economic indicators in the U.S. strengthens the case for potential Yen appreciation against the Dollar.

Traders and investors should closely monitor the price action of USD/JPY as it approaches the lower trend line of the parallel channel. A confirmed break below this level, accompanied by increased trading volume, would provide stronger evidence for the bearish scenario and the potential for further Yen strength.

Furthermore, keeping an eye on key economic data releases from both the U.S. and Japan, as well as any shifts in monetary policy from the Federal Reserve and the Bank of Japan, will be crucial in assessing the validity and potential magnitude of this anticipated move.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.