Crocodile Jaws Open On S&P And Equal Weight, Warning Investors

Institutional traders and investors tend to watch the charts closely. They watch for disparities in price action and divergences. Basically, they look for things that are not normal.

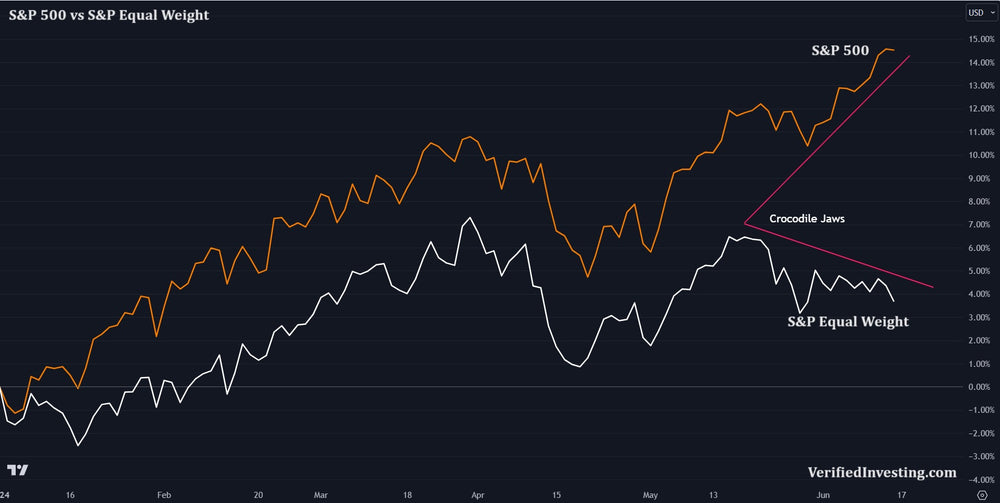

One of the common terms for institutional traders and investors is 'crocodile jaws'. This term applies to divergences. In other words, when two things usually trade together but in this situation the two are diverging away from each other, it is creating 'crocodile jaws'.

This is happening right now with the S&P 500 and the equal S&P 500. Normal market action should see these two generally trending together. If you look at the chart and see for the first 4 months of 2024, they were followings each other closely, the ups, the downs. However, since May the equal weight S&P and the S&P have diverged, forming crocodile jaws.

This is a warning sign institutional investors are taking seriously and retail investors should as well.

Verified Investing reveals the data and truth to investors. While it may not be the popular narrative or the hype investors want to hear, it is facts. Verified Investing wants investors to have the data and charts so they can make their own decisions based on truth.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.