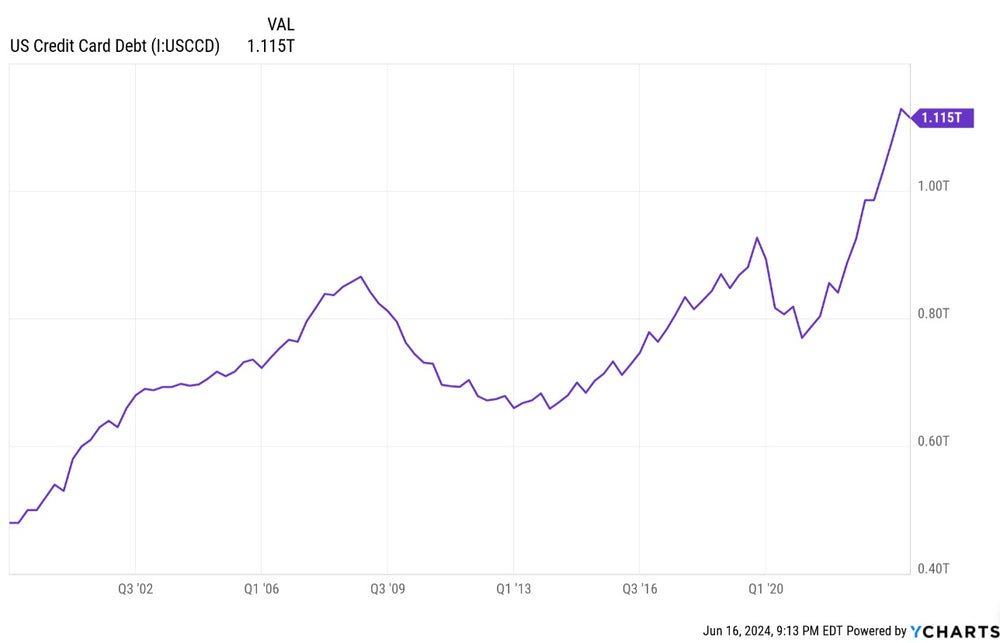

Consumer Credit Card Debt Continues To Soar

During Covid, the savings rate jumped and consumer credit card debt dropped. However, since that period of lockdown the savings rate has plunged and credit card debt is at an all-time high of $1.115 trillion.

In addition, credit card delinquencies are surging. Phantom debt, known as buy-now-pay-later has also surged to almost $700 billion.

To summarize, the consumer is struggling. Inflation is crushing the ability for people to save and they are putting money on credit cards instead. The jump in delinquency rates shows that consumers are now at a point where they cannot keep up with the bills. If the economy slows more, there is big trouble for credit card companies and banks.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.