Credit Card Debt Continues To Spike: The Positives & Negatives

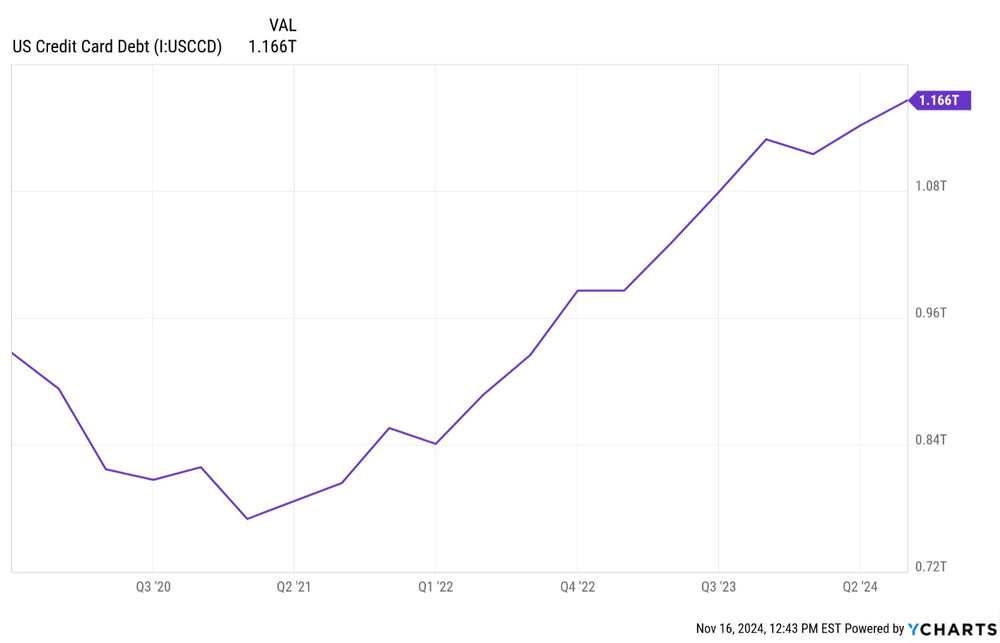

Credit card debt continues to spike dramatically. From pre-covid levels, it has almost doubled. From the covid lows (when people paid off a lot of their debt), it has jumped 120%. This dramatic increase in debt signals a consumer that is relying more and more on credit/debt to keep paying their bills.

While there has been an increase in salary over the last few years, it is not out-weighing the spike in debt. If it continues, there will be massive blow-ups in the credit markets, much like in 2008. The only difference is, it won't likely be the housing market that is the cause.

Let's take a look at the positives and negatives of credit cards.

Positives of Credit Cards:

- Convenience: Credit cards streamline purchases and eliminate the need for carrying large amounts of cash.

- Building Credit: Responsible credit card use, including on-time payments and maintaining a low credit utilization ratio, helps establish and improve credit scores, crucial for securing loans, renting apartments, and even getting certain jobs.

- Rewards and Perks: Many credit cards offer cashback bonuses, reward points, travel miles, or discounts, providing financial benefits and incentives to cardholders.

- Fraud Protection: Credit cards typically have robust fraud protection mechanisms, limiting liability for unauthorized charges and offering a layer of security compared to debit cards or cash.

- Emergency Spending: Credit cards provide a financial safety net for unexpected expenses like medical bills or car repairs, offering a readily available line of credit when needed.

- Interest-Free Financing: Some credit cards offer introductory periods with 0% APR, allowing consumers to finance large purchases without incurring interest charges if paid off within the promotional timeframe.

Negatives of Credit Card Debt:

- High-Interest Rates: Credit card interest rates are notoriously high, and if balances aren't paid off in full each month, the accumulated interest can significantly increase the overall debt burden.

- Overspending Temptation: The ease of using credit cards can lead to impulsive purchases and overspending, accumulating debt that becomes difficult to manage.

- Debt Cycle: Minimum payments on credit cards often barely cover the accruing interest, trapping individuals in a cycle of debt that seems impossible to escape.

- Fees: Late payment fees, annual fees, balance transfer fees, and cash advance fees can add up, further increasing the cost of using credit cards.

- Impact on Credit Score: Missed or late payments, high credit utilization, and defaulting on credit card debt severely damage credit scores, making it challenging to obtain future credit.

What Credit Card Debt Tells Us About the Economy:

- Consumer Confidence: Rising credit card debt can signal increased consumer confidence and spending, indicating a healthy economy. Conversely, declining credit card debt may suggest economic uncertainty or a recessionary environment.

- Household Debt Levels: High levels of credit card debt across households can indicate financial strain and potential vulnerability to economic shocks.

- Interest Rate Environment: Changes in credit card interest rates reflect the overall interest rate environment and monetary policy, providing insights into the direction of the economy.

- Savings Rates: Increasing credit card debt coupled with declining savings rates may signal an unsustainable trend where consumers rely on credit to maintain their living standards.

In essence, credit card debt is a double-edged sword. When used responsibly, it offers convenience, financial benefits, and a means to build credit. However, irresponsible use can lead to a debt spiral, financial instability, and broader economic concerns.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.