Debt Spiral: Gov And Consumers Addicted

The US consumer got used to spending heavily during Covid. This was a period of higher savings as many worked from home and could not travel. However, with high inflation driving up prices, and savings rates plummeting, consumers are still spending like drunken sailors.

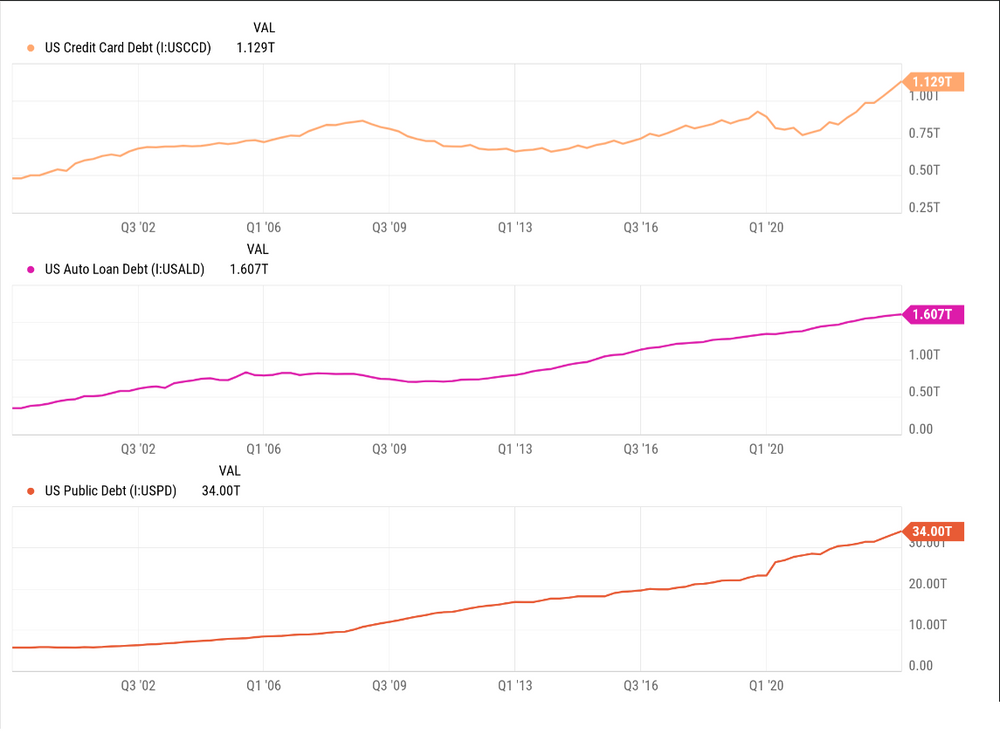

Spending starts at the top and this can be seen in the U.S government. With over $34 trillion in debt, the government has little backbone of cutting spending.

Consumers became addicted to a certain way of life. As savings dwindled, they continue to spend, charging it on credit cards. Credit card debt has now moved to $1.3 trillion.

Auto loan debt continues to soar as well, now above $1.60 trillion.

As long as the economy is strong and the stock market is at all-time highs, there is little chance of issues arising. However, should the economy falter, these debt levels will become a hazard that could cause another financial crisis.

One last thing to note, during economic good times, it is imperative that governments pay down their debts. Government spending is supposed to increase during recessions (not expansions) to stimulate growth. For the US government to be racking up excessive debt during expansionary periods like it is now, it should scare every single person. Debt will only explode even higher when a recession hits.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.