Economic PCE Inflation Data Jumps As Markets Fear Stagflation

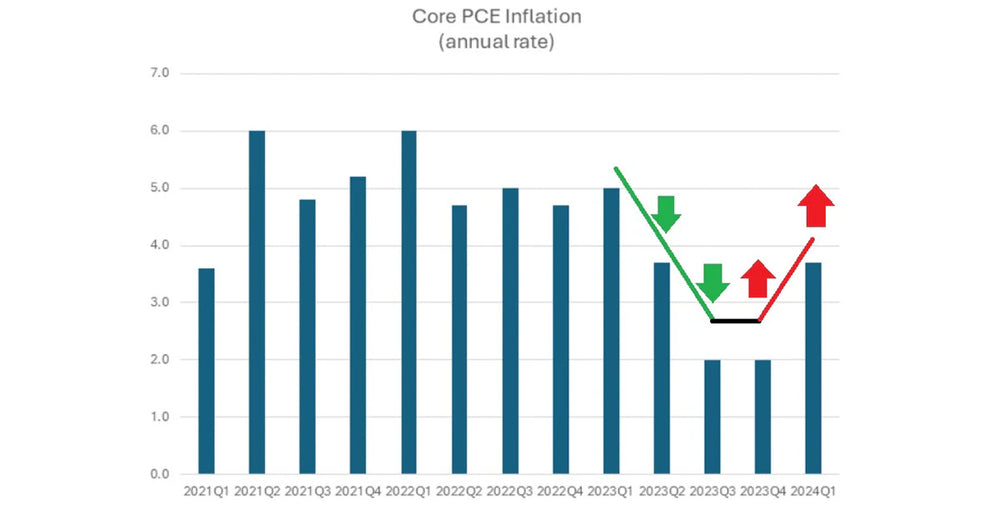

The core PCE price index rose to 3.7% annually, shocking investors. Inflation is rearing its ugly head and starting to surge back up. Economists are now pricing in only one rate cut in 2024 and some are even wondering if the Federal Reserve will have to raise interest rates.

The combination of a surprise drop in GDP and rising core PCE inflation signals possible stagflation.

This term means slowing growth and rising inflation. Historically, inflation tends to rise when the economy is good. This means consumers can absorb the rising costs as they are making more money during a strong economy. However, with stagflation, the economy is slowing, people are losing their jobs, making less money and inflation is still rising. This means consumers have much more trouble absorbing higher inflation costs. In reality, it is the worst situation of all.

In does not take a genius to see that commodities across the board are soaring. From cocoa to coffee and oil to gasoline, prices are sharply higher across the board. This means the Federal Reserve is likely handcuffed from doing anything major if the economy tumbles.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.