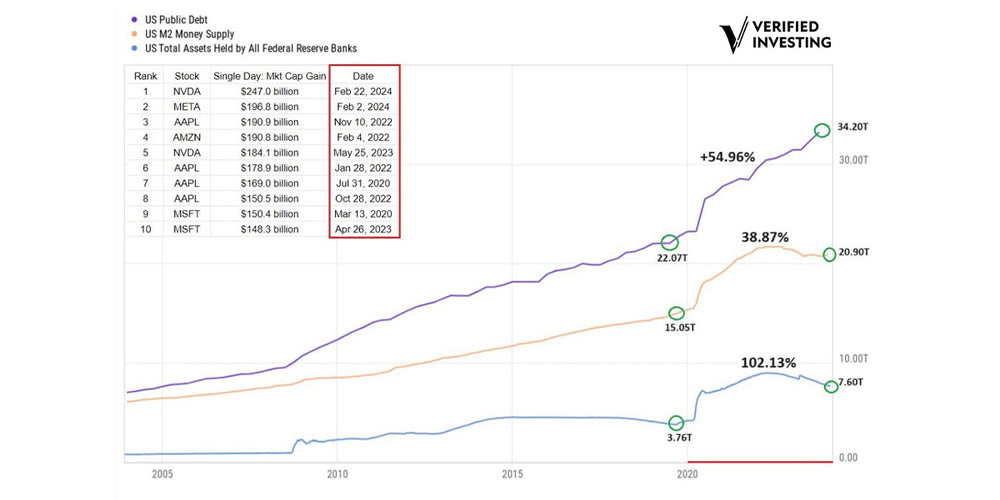

Why Money Printing Never Went Away: Fed Balance Sheet, M2, US Debt

A lot has been made about the Federal Reserve raising interest rates to slow inflation. However, multiple economic metrics prove that has not happened. It also explains why inflation is back on the rise again.

The Federal Reserve Balance sheet has been reduced a total of 15% since rates jumped higher and is still up a whopping 102.13% since the Covid Pandemic.

M2 money supply is down slightly since the Federal Reserve began tightening however, it is still up almost 39% since the Covid Pandemic.

While the prior two metrics have seen a tiny drop, US Debt has surged 55% since the Covid Pandemic and just since the Federal Reserve began tightening, it has risen by over $4 trillion. This eclipses the drops in M2 and the Federal Reserve balance sheet.

Ultimately, the more debt in the system and money in the system means more trouble on the horizon. It also likely means more inflation.

The rise in these metrics also showcases why risk assets remain at all-time highs. Whether it is the stock market or crypto, money is plentiful and finding its way into the markets. This creates bubbles that will eventually collapse.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.