Federal Reserve Never Unwinds Their Debt Prior To The Next Crisis

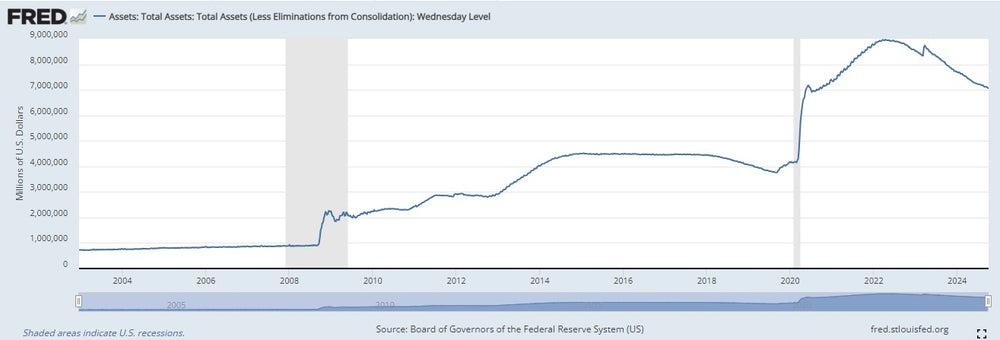

The Federal Reserve is addicted to debt, just like the rest of the country. Their plan has been to take on massive loans (balance sheet) during a crisis, then unwind it. The problem is, the data shows they only unwind approximately 20% before the next crisis makes them double their balance sheet again.

This can be seen in the above chart where the Federal Reserve had a balance sheet under $1 trillion prior to the financial crisis. Their balance sheet ballooned to $4.5 trillion in the following years. This was a 310% increase in the balance sheet as the Federal Reserve stimulated the economy following the financial crisis.

From $4.5 trillion, their balance finally began to shrink. It fell back to $3.7 trillion before Covid hit. The Federal Reserve balance sheet ballooned again from $3.7 trillion to $9 trillion. This time jumping 143%. With the economy having its best stretch of growth in decades, the Federal Reserve has only reduced their balance sheet to $7 trillion. That reduction is now coming to a close.

At some point in the future their will be another recession and crisis and investors should expect the Federal Reserve to double their balance sheet at a minimum.

This path is unsustainable, just like the national debt and its rapid growth. Whether the house of cards collapses in a year, five years or a decade, it will have a reckoning day.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.