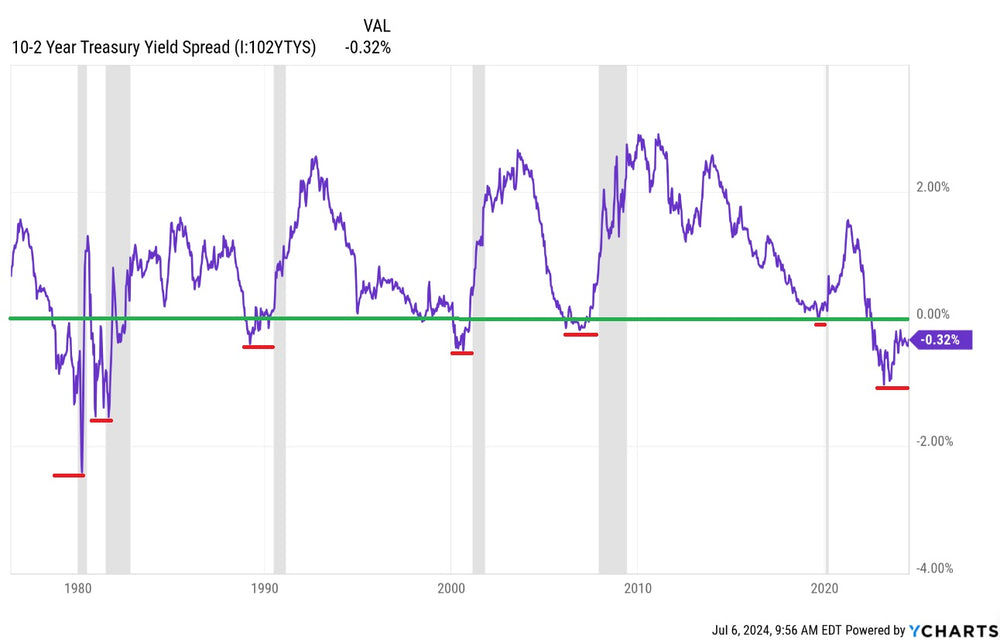

History: Yield Curve Inversion Should Worry Investors

The yield curve is generally measured by the difference between the 2 year yield and the 10 year yield. In a 'normal' economy, the longer duration of a bond, the more interest an investor will demand. This makes sense as the longer someone has to hold an investment, the more they require in interest. This means that generally the yield curve is a positive number.

When the yield curve inverts it means there is something wrong in the system.

The yield curve inverted in July of 2022. A two year yield curve inversion is the longest on record. Every time the yield curve inverted it has signaled a recession on the horizon. However, it is important to note that the recession does not usually hit until the yield curve un-inverts. In other words, the inversion is a warning, the trigger is the un-inversion.

Even when comparing the yield curve inversion prior to the Great Depression, it was not inverted for this long. This is an ominous signal for the future of the United States and much of the world. Investors beware.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.