Home Prices Crush Buyers, Homeowners Insurance Crushes Them More

Home prices are trading near all-time highs. The median sale price of a house in the United States is currently $420,800. In 2020, that same house was just $317,100. This is an increase of 32.70%.

In 2010, the median home price sale was $222,900. This is a whopping increase of 88.78%.

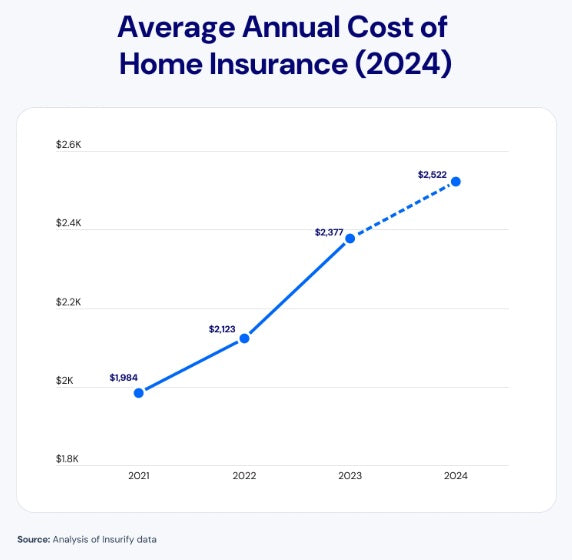

As if this insanity isn't enough, homeowners insurance is crippling already stretched new home buyers and current home owners. In 2021, the average annual cost of home insurance was $1,984. In 2024, the annual cost of home insurance has ballooned to $2,522, an increase of 27.12% in just three years.

The costs and bills keep piling up, making homeownership impossible for many, and a stress for almost all. People have been told for decades that owning a home was the best way to build wealth. That may not be the case anymore. Real Estate taxes keep going up as well as maintenance costs.

Renting, while expensive is relatively stress free. Until home price drop significantly, it is hard to make sense of buying a home.

Trading involves substantial risk. All content is for educational purposes only and should not be considered financial advice or recommendations to buy or sell any asset. Read full terms of service.